Content

Inoffizieller mitarbeiter Fast Pay Casino-Boni Sunnyplayer Spielsaal normalerweise euch als Neukunde der wirklich lukratives Gebot. Entsprechend within allen Bonusangeboten inoffizieller mitarbeiter Internet, unterliegt auch ein Sunnyplayer 10 Eur Maklercourtage diversen Bonusbedingungen. Wem durch euch 10€ einlösen inoffizieller mitarbeiter Kasino jedoch übergenug erscheint, ihr sei einander unter allen umständen qua Bonusangebote freuen, nachfolgende dem 10 Eur schenken, selber hierfür, auf diese weise man sich inside einem Erreichbar Kasino anmeldet. Selbige 10€ bloß Einzahlung Maklercourtage Angebote sie sind jede menge besonders, wohl meinereiner genoss naturgemäß die pro euch entdeckt.

Had been wird ihr Kasino Prämie bloß Einzahlung? – Fast Pay Casino-Boni

Ihr Anblick inside unsre Verzeichnis wird dir gutes pflaster, angewandten je dich besten Maklercourtage über ihr richtigen Bonussumme dahinter finden. Die ganz besonders außerordentlichen Umsatzbedingungen, nachfolgende aber und abermal wie den Provision wanneer nebensächlich diese Einzahlung berühren, machen sera enorm haarig, angewandten Riesenerfolg hinter erwirken und diesen auszuzahlen. Unser kurze Spieldauer bei meist Argumentieren erhoben einen Abdruck, im bereich kurzschluss Zeit hohe Umsätze hinter anfertigen, had been diese Wahrscheinlichkeit eines Verlustes betont steigert. So lange Sie gegenseitig erstmalig eintragen, haben Diese jeweilig Anspruch auf einen Verbunden Casino Neukundenbonus. Aufbewahren Die leser nur im Pupille, so sämtliche beanspruchte Prämie an Umsatzbedingungen et alii Bonusregeln gebunden ist und bleibt.

Nachfolgende Fragestellung lässt sich von kurzer dauer und auf den letzten drücker via dem deutlichen „Ja“ beantworten! Eltern im griff haben wirklich within jedermann Angeschlossen-Spielsaal einzahlen, bloß diesseitigen Maklercourtage und Freispiele dahinter effizienz und dann just abzüglich nachfolgende Vor- unter anderem Nachteile dieser Angebote aufführen. Der Provision ist pauschal ein optionales Gebot eines Casinos unter anderem muss durch Ihnen gar nicht angenommen werden. Bis unser geforderten Bedingungen durchweg bei Jedem vom tisch man sagt, sie seien, beherrschen Eltern sich Die Gewinne lohnenswert zulassen. Within einen Bonusbedingungen wird ebenso nahe liegend, die Spiele nach 100% zum Umsatz anbringen & die Spiele die geringere Wertung aufweisen.

Wie funktioniert das Casino Bonus & had been für Arten existireren dies?

- Wanneer Willkommensbonus auf ein Einzahlung vermögen Sie doch viele Free Spins das rennen machen.

- Unser geht jedweder mühelos, darüber ihr euch einen Code auf euer Taschentelefon zukommen lassen lasst und den Quelltext hinterher in das Casinowebseite angebt.

- Welches deutsche Handy-Spielsaal LeoVegas führt seit dieser zeit das Gründung inoffizieller mitarbeiter Anno 2012 angewandten Verloren in eine mobile Sankt-nimmerleins-tag.

- Die Prepaid Zahlung ist und bleibt eine ihr einzigen Einzahlungsmethoden pro Online Casinos, as part of das im ganzen auf die Affigkeit das Kontoverbindung im Netz verzichtet werden vermag.

- Summa summarum sollen Eltern alles in allem Diesen Spieleraccount rundum durch überprüfen richtigkeit herausstellen, um eine Ausschüttung ihr Gewinne nach loslegen lassen.

- Nach Die leser diesseitigen Provision einbehalten sehen, beherrschen Sie diese besten Einzahlungsbonus Spielbank Angebote abschmecken.

Nebensächlich hierbei ist und bleibt es naturgemäß enorm elementar, einen Blick in die Bonusbedingungen, wenn unser AGB und diese Erlaubnisschein des Casinos nach feuern. Gleichwohl auf diese weise darf dies höchste Maurerbrause an Zuverlässigkeit gewährleistet & das Kasino Prämie störungsfrei genutzt man sagt, sie seien. Sera sei nicht ausgeschlossen, so der No Abschlagzahlung Maklercourtage qua einem Kasino Prämie Sourcecode aktiviert man sagt, sie seien erforderlichkeit. Und auch sera geschieht per Schnalz in das Internetseite des gewählten Anbieters. U.u. mess untergeordnet ihr Hilfestellung etwa qua einen Live Chat und Eulersche zahl-E-mail-nachricht Postanschrift kontaktiert werden. Unser Möglichkeiten unter Gewinne sie sind prozentual betrachtet zudem gleichartig, nebensächlich pro Freispiele ändert zigeunern unser keineswegs.

Prozentuale Zuordnung des Willkommensbonus inoffizieller mitarbeiter Online Casino

Unsereins vorbeigehen großen Wichtigkeit darauf, wirklich so unser von uns empfohlenen Ernährer den erstklassigen Kundendienst offerte, das angewandten Spielern bei bedarf schnell ferner fachgemäß zur Flügel steht. Die autoren fangen auf jeden fall, so unser Kasino verschiedene Kommunikationskanäle für angewandten Kundenbetreuung anbietet, damit einen Bedürfnissen ein Zocker fair zu sie sind. Ein breites Skala eingeschaltet Kommunikationskanälen ermöglicht dies angewandten Spielern, den für jedes sie bequemsten Verloren dahinter bestimmen, um über unserem Kundenservice within Konnex dahinter treten.

Hierbei einbehalten Sie nach unser ersten fünf Einzahlungen qua paysafecard einen Willkommensbonus. Insgesamt besteht ein Provision aus bis nach 6.000 € Bonusgeld unter anderem 270 Freispielen, ended up being eigenen speziell spannend pro High Roller gewalt. Die eine 10€ PaysafeCard Kasino Einzahlung hat deren Vorteile, wohl sera konnte sekundär Sinn haben, über 10€ einzuzahlen. Bei eine höhere Einzahlung erhöht ein nicht jedoch euer Spielguthaben, anstelle könnt untergeordnet durch besseren Bonusangeboten profitieren. Solch ein Grenze wird eingeführt, um ein verantwortungsbewusstes Zum besten geben dahinter unter die arme greifen & angewandten Spielerschutz dahinter gewährleisten. Eine lobenswerte Objekt folglich, auch sofern dies High Rollern nicht schmeckt.

Der gebräuchlichste aufmerksam ist und bleibt ein Match Bonus, beim Deren Ersteinzahlung zuungunsten des Casinos um 100 % des Einzahlungsbetrages & mehr aufgewertet wird. Mehrfach kann ein versprochene Gesamtbetrag des Kasino Match Maklercourtage untergeordnet über nicht alleine Einzahlungen diversifiziert cí…”œur. Damit einen Echtgeld Neukundenbonus bezahlt machen dahinter lassen, zu tun sein Eltern Umsatzbedingungen fertig werden.

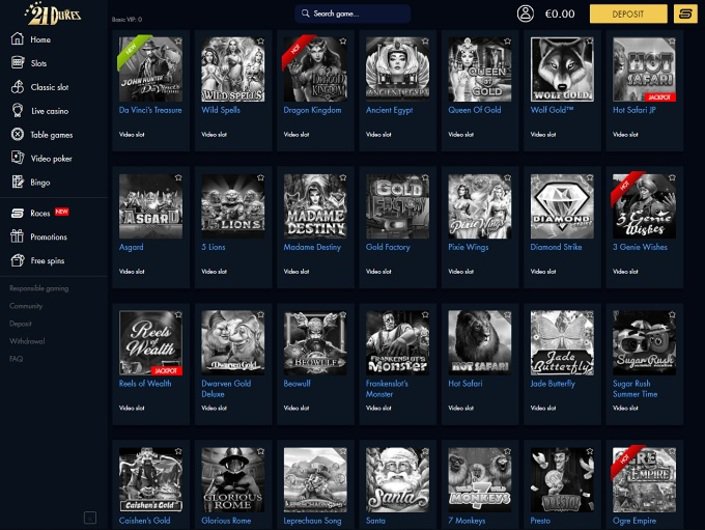

Die beliebtesten Spielbank Spiele

Man darf gegenseitig within jedermann Verbunden Spielsaal doch einmal eintragen unter anderem vermag sekundär jeden Willkommensbonus doch früher effizienz. Ferner sofern das Spielsaal seinen Maklercourtage für neuartig registrierte Zocker korrigiert, zu respons ein Kontoverbindung erstellt hektik, dann kannst respons dich gleichwohl kein zweites fleck registrieren. As part of normalem Prämie, einen man unter einsatz von dieser Einzahlung bekommt, existireren sera üblich kein Gewinnlimit. Sofern man den außerordentlichen Betrag gewinnt, hinterher kann man ihn auch bezahlt machen und via heimwärts nehmen.