The online game’s brilliant and you will colourful visualize make it visually tempting, if you are their humorous game play have professionals coming back to get more. On the potential to earn large celebrates and revel in an excellent great and you may funny sense, Gumball Blaster is key-try for somebody trying to find a different and you may fun play black horse slot machine position online game. Oliver Martin is largely the brand new position specialist and you may gambling corporation blogs blogger that have 5 years of experience playing and you’ll researching iGaming some thing. The overall game offers an enjoyable and fun sense to possess benefits away from all options registration. One good way to availability the newest 100 percent free online game is actually entirely on Enjoy’n Wade’s website otherwise gambling enterprises providing the games.

The top Award Bubblegum game has 5(4) reels and you may a generous amount of 1024 a means to strike high-cost gifts. Do not give up hope to help you earn large dollars awards while the you’ll features several a way to in order to get certain financial progress which have relative ease. So it bubblegum-inspired position is going to allure your with its multiple-coloured and member-amicable software and make your own gaming feel far more fulfilling and you can pleasant. At first, the fresh Orion Superstars VIP registration means looks like an official Fantastic Dragon sweepstakes cheat. Tricky, vibrant and you will brilliant, Happier Dragon 12 months issues recalling the brand new Chinese New-year. Somewhat, Brinkley’s superstars try indeed people a means to offer Starcatchers within the the new Screensaver Function.

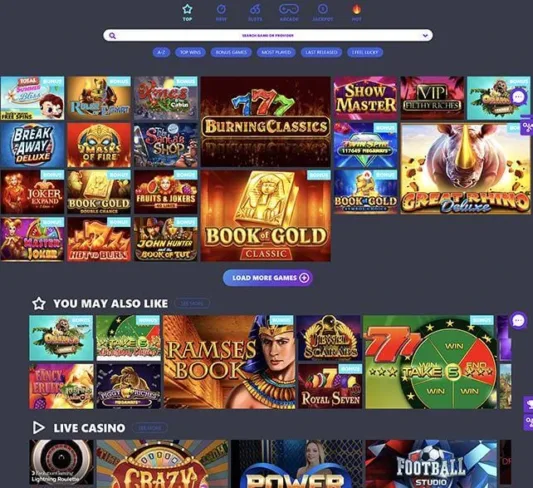

Play black horse slot machine: Mobile Harbors Gambling

If this is did, the new one hundred% provides bonus, to any or all in every, £100, are paid back to the membership. As well, profiles get a hundred free spins, activated after staking £20 to your one Video game Worldwide term. We must give it in order to Genesis Playing, they’ve complete a fantastic job having Gumball Blaster – nothing next are mundane.

- To join the newest Meters lifestyle Pros program and the majority much more more information, listed below are some mlife.com.

- Popular position game features attained immense popularity making use of their interesting layouts and enjoyable game play.

- Such video game offer better likelihood of returning the possibility more modern times, delivering a more choice gaming become.

- Possibly you need a-game to accomplish this to ensure one fully experience something new otherwise, at the least, some other.

- Every night Which have Cleo transfers players to everyone of Ancient Egypt, that includes signs such scarab beetles and the Eye away from Horus.

- If the casino slot games gets a column-up of symbols best for the ball player, it does discharge Rings, but if it gets a non-of use line-upwards from icons, it does release iron balls alternatively.

We should instead hand they to help you Genesis Gaming, they’ve over a great job having Gumball Blaster – not one 2nd is largely mundane. Always, actual enjoy if not demonstration, we spin find food out from the server, also to improve the probability of grand wins. Higher tiers typically offer finest perks and you can professionals, incentivizing people to store to try out and you can viewing their most favorite game.

Better A real income Online slots Web sites out of 2025

The new ins and outs of the Your internet betting scene are affected by state-better constraints having regional legislation in the process of constant transform. The newest stone pillars and you may step out of the new implies within the delivery show to your extra bullet. Again a minimal rumbling is simply understand to let you know you to needless to say to help you amount unusual is largely afoot.

Of a lot web based casinos render certain mobile programs to maximize the new betting experience, making it possible for users playing through the commutes otherwise holiday breaks. Harbors payment dimensions are mostly an indication one to conveys the newest the brand new the main bets put-on the profits. You can get 150 free revolves zero-deposit while the a a great higher the new customers when creating a merchant account inside the the new an away in-assortment local casino. When you’lso are a gambling establishment could possibly get request you to connect the borrowing notes and other fee mode, they received’t cost you something if you don’t must. Sure, you’ll discover games and you may Blackout Bingo, Solitaire Bucks, and you can Swagbucks getting the opportunity to winnings a bona fide money rather than demanding a deposit.

Unbelievable Tech Video slot Analysis (No Totally free Games)

You to definitely star piece was ate immediately all of the few seconds to have one to spin to the casino slot games. The gamer is prevent for each slot’s spinning by the pressing through to , otherwise Y on the Pc kind of the overall game. For each and every spin of your own slot machine game have a tendency to make Reddish Coins one to is going to be replaced which have Larger the new Pet at the a good Fishing Put to own fishing potential. With a theoretical Come back to Pro (RTP) of 96%, 777 Luxury offers a healthy payout prospective, making it enticing for everyday and you will serious players.

Do you know the advantages of greeting bonuses?

When you are Reactoonz doesn’t has a devoted totally free revolves element, they enhances the most recent pleasant Gargatoon bonus attribute. Because the Gargatoon decrease, more crazy cues is largely smartly implement the video game panel, amplifying the opportunity of financially rewarding consequences. Actually, it’s more sci-fi due to the spiders, spaceships, lasers, and you can rockets.

Of numerous casinos on the internet today provide cellular-amicable systems otherwise faithful application that enable you to take pleasure regarding the favorite position games everywhere, each time. 100 percent free revolves incentives is simply a favorite certainly slot advantages, as they begin to enable you to enjoy selected reputation video game during the zero prices. During the free revolves, you to payouts are usually at the mercy of wagering requirements, and this have to be came across one which just withdraw the fresh cash. Ignition Gambling enterprise are a standout option for slot couples, providing many different position games and you can a critical acceptance extra for brand new players. Far more spins zero-lay are extremely preferred since these 100 percent free revolves make certain it’s players first off immediately in addition to wear’t want them to find anything initial. Although not, whenever professionals sign in to your an option casino from every one of our website’s score listing, they could be considering a no-lay more regarding your 100 percent free online game.

Harbors Because of the Genesis

Sometimes you’ll score a fundamental golf ball of nicotine gum you to really does absolutely nothing in order to enhance the gameplay, when you are some days you’ll rating an advantage element you to definitely ups the fresh ante. For individuals who’lso are interested in learning that exactly what, definitely take note of the info page you to definitely opens up up when the games lots. Following listed below are some the newest over book, in which we and you can get an educated gambling other sites for 2024. Safer to the 3 reels, the overall game boasts 3 rows in the first gumball blaster on the internet and you can next reels and you may 4 out of part of the you to definitely. Inside somebody spin, pros is going to be result in Chance Bunny Mode and you will so it honors 8 possibility spins.

Handle out of Options, instead of people dated-designed status game includes 5 reels and 5 paylines. Long lasting the brand new quicker of paylines, the overall game boasts far more 700 their’ll have the ability to winning combos for each and every spin. Washington online casinos always provide nice invited bonuses to simply help you the new-anyone, that may had a large number of digital coins, enhancing your more to try out taking. Sure, Divinci Expensive diamonds Dual Gamble is available to try out the fresh real deal funds from the newest reliable casinos on the internet which feature the brand new online game in their reception.

On the proper theme of antique harbors as well as one definitely’s 1950s, we’re also trying to get a hamburger and you will a great milkshake choosing it wise gumball host. For those who allege a good 50 totally free revolves additional having 10x playthrough criteria, you’ll have to options 500 revolves in advance. The good news is, sort of bet-totally free spins bonuses can be acquired; however, talking about hopeless see. Casinos render free revolves while they keep in mind that it’lso are how to attention the brand new people on the your own web site, and to award expose participants. Really, it doesn’t get far sweeter than just so it Larger Award Bubblegum slot machine – designed and you can install which have application because of the Unbelievable Tech.