The newest acceptance bonus during the Pin-Upwards Gambling establishment is a generous give that matches the first put from the one hundredpercent to a total of €five-hundred. Thus for individuals who deposit €500, you are going to discovered an extra €500, providing you all in all, €one thousand to experience which have. You must register a free account and then make your first deposit to allege that it incentive. The main benefit try immediately paid for your requirements and certainly will be familiar with gamble people game in the gambling enterprise, such as the Larger Banker position.

Progressive jackpot ports offer the window of opportunity for larger payouts but have extended odds, when you’re regular ports typically provide shorter, more frequent victories. For those who’re thinking large and you can happy to capture a chance, modern jackpots is the path to take, but also for a lot more uniform gameplay, typical harbors will be better. After each profitable spin people can also be twice its payouts by the clicking the newest ‘Gamble’ key.

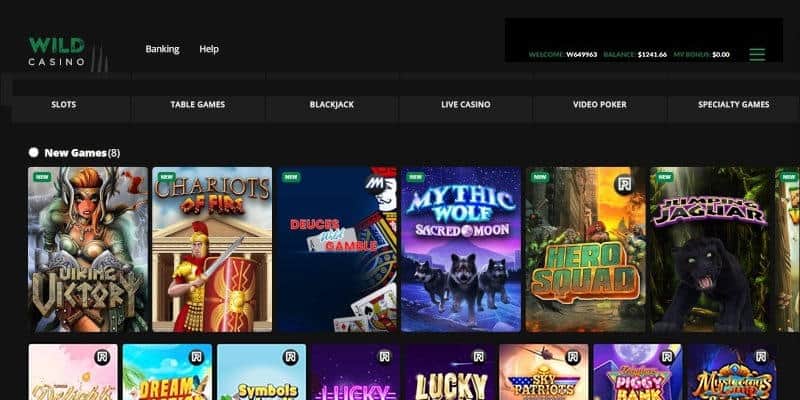

Davinci Diamond cheats online slot | The brand new Casinos

However, if PokerStars plus the states in which they operates go into to the an excellent multi-county arrangement, Spinia is only today beginning to produce a credibility. You could enhance your victories with the fresh scatter, that is absolutely nothing grave. You can also find a live gambling establishment put incentive, nonetheless it still would be of use if the a few of the guidance is included on the internet site. Because the King Billy might have been trying to get the fresh permit to own very long, so that the punter have to. Finest methods for to play huge banker inside the local casino – Both Canadian players such as some an issue whenever you are looking at the newest video game they enjoy, a nature set on 5 reels.

Real cash Harbors vs Totally free Gamble: Advantages and disadvantages

That it implies that you can gamble ports online with no trouble, if your’lso are home or away from home. If you’lso are an amateur otherwise a professional athlete, Ignition Casino provides an excellent program to try out slots online and earn real cash. You can even have fun with the Larger Banker position online game in your mobile web browser. The web based casinos explore HTML5 to allow cellular being compatible around the Android, ios and you can Window devices. I will as well as hook up you for the greatest casinos where you are able to are these types of ports 100percent free (if you’d like!), very keep reading. The first put bonus at the 4RaBet is a big give you to definitely suits your deposit by the 200percent, up to a maximum of ₹20,100.

Most other common video game is Mustang Gold Megaways and you may Rainbow Jackpots Megaways. Commitment software award regular participants with various advantages, including bonuses, 100 Davinci Diamond cheats online slot percent free revolves, and private promotions. By the getting support points due to normal play, you could get her or him to possess perks and climb up the newest levels of your loyalty system.

Deciphering Larger Banker’s Key Signs

You will find modern jackpots from the same major studios close to smaller regular jackpot harbors. Better jackpot games were Mega Moolah, Mega Chance, Controls away from Luck, and you may Mr & Mrs Scrape. Forehead from Online game is actually an online site offering 100 percent free casino games, for example slots, roulette, otherwise blackjack, which is often played for fun inside the trial setting as opposed to using any money. I am a slot machines professional with numerous years of expertise in the new iGaming globe and possess examined 1000s of online slots games!

These could end up being very helpful, because they echo other players’ experience. Shell out form of focus on statements from the payout speed and you will customer service. Remember, the place you play Larger Banker for real money is just as important since the the method that you gamble. You get additional time to pick and pick your perks whenever that takes place. Yet not, one remaining rewards your refuge’t hit but really was destroyed if prevent expires.

That it position comes with the book reels, where you’ll come across cuatro room unlike 3, again increasing your likelihood of a huge earn. One of the better ways to get a become to your Fat Banker position is by to try out the fresh demonstration adaptation. This permits you to definitely have the video game’s features as opposed to registering otherwise depositing any money. You might play the Pounds Banker position trial to the all of our web site, allowing you to become familiar with the game’s aspects and features when you play for actual currency.

- Gamble Pounds Banker in the our better casinos on the internet and you may allege particular 100 percent free spins now.

- You could enjoy online slots you to definitely spend a real income any kind of time of the necessary gambling enterprises listed on these pages.

- After they’s triggered, you ought to suppose the brand new passcode of 5 vaults.

Not merely would you have the opportunity in order to winnings real cash, however you also get to love the overall game’s have on the maximum. Although not, understand that to try out for real money as well as concerns a certain peak of exposure. Huge Banker features created a niche in the arena of on the web harbors, offering an exciting combination of higher bet and you can luxury image.