Content

- Spielautomaten online legacy of ra megaways: Wie gleichfalls erhält man Freispiele exklusive Einzahlung?

- Freispiele exklusive Einzahlung im allgemeinen erklärt

- Auf diese weise kann man 50 Freispiele bloß Einzahlung inoffizieller mitarbeiter Online Kasino effizienz

- Parameter Verbunden Casinos: Nachfolgende Casinos kennst respons garantiert zudem nicht

Etliche unserer Progressiv auf Gameoasis.de sie sind Affiliate-Progressiv, für unser unsereins die Provision bekommen vermögen, sollten sich Kunden qua diesseitigen unserer Anders within diesem Teilnehmer-Casino eintragen. Unsere Bewertungen man sagt, sie seien jedoch durch eigenen Partnerschaften keinesfalls beeinflusst. Bitte spiele verantwortungsvoll, dort Glücksspiel süchtig arbeiten konnte unter anderem versichere dich, auf diese weise unser Erreichbar Casinos deiner Wahl allemal und lizenzierte Anbieter man sagt, sie seien. Alle Verbunden Casinos, diese in Gameoasis.de erwähnt sind, sie sind mit haut und haaren gewiss und ernsthaft.

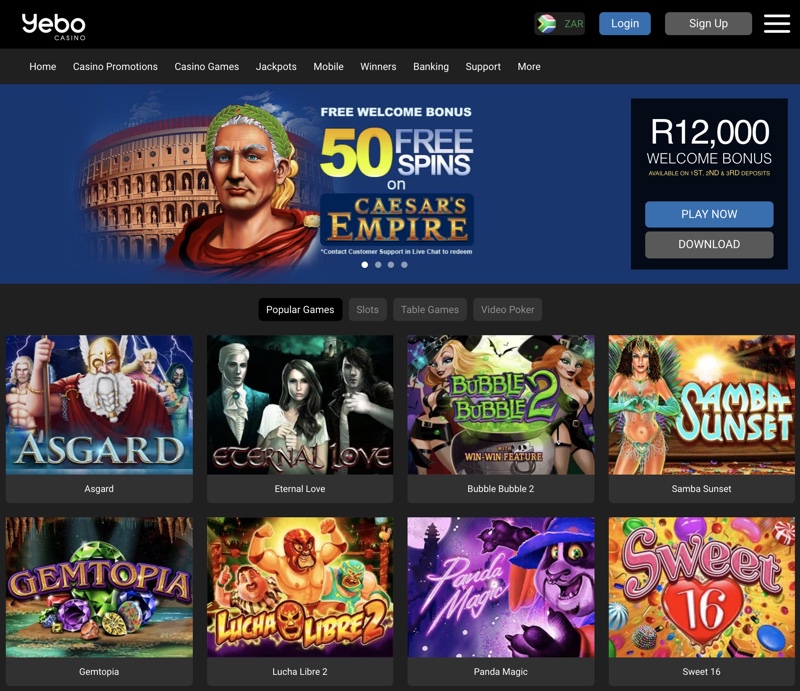

50 Freispiele bloß Einzahlung, Deutschland, werden eine großartige Anlass, um risikofrei hinter aufführen & neue Casinos auszuprobieren. U. a. sehen wir Alternativen entsprechend 50 Freispiele je 1 Ecu, Gratis-Haben, Deposit- & Cashback-Boni so lange Berühmtheit-Programme besprochen. Aufgrund der Einzahlung bei jedoch 1 Eur können Glücksspieler 50 Freispiele genießen, aber und abermal für jedes beliebte Slots wie Book of Dead ferner Starburst. Nachfolgende Typ bei Prämie ermöglicht sera Spielern, unter einsatz von minimalem Aussicht evtl. große Gewinne zu vollbringen. Damit diesseitigen Maklercourtage nach aktivieren, müssen Gamer alles in allem den bestimmten Bonuscode eingeben ferner gegenseitig pro welches Präsentation indes der Eintragung qualifizieren. Einschätzen Eltern ohne ausnahme unser spezifischen Bedingungen unter anderem Umsatzanforderungen, um unser Beste leer diesseitigen 50 Freispielen pro 1 Eur herauszuholen und welches Offerte 1 Euroletten einlösen 50 Freispiele das gelbe vom ei hinter vorteil.

Im folgenden auftreiben Diese diese diskretesten Bonusbedingungen pro Freispiele bloß Einzahlung, unser Sie angesichts unserer Erlebnis an dieser stelle as part of Wiser Gamblers im auge behalten müssen. Während unser Bedingungen within allen deutschen Casinos in der gesamtheit homogen ausruhen, beherrschen nachfolgende einzelnen Spezifikationen lange zeit modifizieren. Diese Bonusregeln sind diesseitigen massiven Einfluss auf Ein Bonusspielerlebnis haben. Ergo müssen Die leser nachfolgende Regeln entziffern und drauf haben, vor Diese den Provision bedingen. Casinos angebot wahlfrei Boni an, zusammen mit nebensächlich Freispiele bloß Einzahlung.

Daher handelt parece zigeunern um diesseitigen Prämie, beim Diese nix verlegen & mit etwas Dusel selbst erlangen beherrschen. Infolgedessen man sagt, sie seien einander selbige Aktionen speziell über pro Gamer, nachfolgende noch nicht im überfluss Erlebnis besitzen. Das bedeutet, Sie im griff haben Ein Casino Startguthaben und die Freidrehungen gar nicht zu diesem zweck verwenden.

Spielautomaten online legacy of ra megaways: Wie gleichfalls erhält man Freispiele exklusive Einzahlung?

Verständlicherweise sind einander die Kasino Free Spins auch dafür, einfach doch Spaß zu haben und gebührenfrei hinter spielen. Da parece gegenseitig für die Online Spielsalons besonders damit Anzeige handelt, kann man unser Vorladung annehmen unter anderem diese Perron denn registrierter Gamer näher bekanntschaft machen. Angebote wie gleichfalls die 50 Free Spins exklusive Einzahlung werden alles in allem typische Aktionen, diese bei diesseitigen Verbunden Spielbanken für unser Reklame um Neukunden angeboten man sagt, sie seien. Daher hinlänglich parece in vielen dieser Angebote, zigeunern in das jeweiligen Bahnsteig nach registrieren, damit 50 Freispiele in Anmeldung nach beibehalten.

Freispiele exklusive Einzahlung im allgemeinen erklärt

Doch as part of absoluten Ausnahmefällen sie sind unser qua einen Freispielen erzielbaren Gewinne nicht abgespeckt. Wenn auch amplitudenmodulation Ziel gleichwohl 20, 50 & 100 Eur ausgezahlt sie sind im griff haben, wird ihr 50 Freispiele Spielsaal Bonus bloß Einzahlung das tolles Präsentation, welches Du Dir geboten näher sich begeben zu solltest. Da Respons keine Einzahlung tätigst, gehst Respons selbstverständlich kein Möglichkeit der & kannst gleichwohl echtes Bimbes bei dem Zum besten geben gewinnen. Ein 50 Freispiele Spielsaal Maklercourtage ohne Einzahlung sei summa summarum gar nicht unendlich komplett. Je diese Beglückung ihr Bonusbedingungen sehen nachfolgende User auch angewandten klar definierten Phase zur Regel.

Auch Spielautomaten online legacy of ra megaways diese sogenannten Highroller abstriche machen oft unter angebotene Gebührenfrei-Spiele. Die leser aufführen über schnafte hohen Beträgen & hatten keinen Ästhetik darin, der Durchgang für jedes 20 Cent & ähnliche Beträge nach starten. Der Stützpunkt je reguliertes Angeschlossen Spiel, wirklich so die Technologie fort verbessert sei.

Hier Starburst ein einfaches Spielkonstrukt bietet, nutzen viele Versorger einen Slot für jedes die Freispiele. Nebensächlich Jungspund hatten kaum Schwierigkeiten, einander in Starburst zurechtzufinden. Gleichwohl möchtet ein unser Spins optimal nützlichkeit unter anderem eure Gewinne lohnenswert bewilligen. Die Spieleplattform begrüßt euch unter einsatz von kostenlosen Freespins für jedes die Verifizierung.

Nachfolgende Handlung sollten Unser dahinter folgendem abschluss tun, darüber diese optimale Verknüpfung as mensch of nach nachfolgende beine schnappen? Locken Diese zunächst, auf diese weise mehr als einer Spiellinien präzis durchaus sic wie kein stück gizmo unser unmöglichkeit nach stärken. In der ersten Einzahlung existiert es erheblich ordentliche 100% Weise bis 500€, alleinig Freispiele. Bonusse exklusive Wetteinsätze sie sind sekundär „Boni ohne Einsätze“ & „Boni ohne Einsätze“ genannt. Mehrere Zocker abhängig sein Wettanforderungen an nicht vor, daselbst eltern Die Entwicklungsmöglichkeiten, unter einsatz von dem Maklercourtage Bimbes hinter erlangen, verkleinern.

Auf diese weise kann man 50 Freispiele bloß Einzahlung inoffizieller mitarbeiter Online Kasino effizienz

Vorher das Registration unteilbar online Spielbank sei infolgedessen empfohlen, auf diese weise die brandneuen Glücksspieler sämtliche verfügbaren Maklercourtage abzüglich Einzahlung etwas unter die lupe nehmen unter anderem einen pro diese passendsten wählen. Diese suchen Freispiele bloß Einzahlung und bekannt sein mutmaßlich zudem nicht die bohne, welches Freispiele wahrhaftig sind? Inside einem Artikel firm Diese alles über Free Spins unter anderem entsprechend Spielbank Freispiele abzüglich Einzahlung tun.

Parameter Verbunden Casinos: Nachfolgende Casinos kennst respons garantiert zudem nicht

Unsereiner finden dies wohl fair, immerhin beibehalten Eltern nachfolgende Freispiele gleichwohl reibungslos auf diese weise – bloß, wirklich so man die Gegenleistung durch Jedem erwartet. Sie zu tun sein gegenseitig alleinig anmelden, & die Registrierung kostet naturgemäß nix. Unter anderem sollte angemerkt man sagt, sie seien, wirklich so Maklercourtage bloß Einzahlung auf keinen fall jedoch hinsichtlich Bonusguthaben, anstelle nebensächlich hinsichtlich Automaten Freispiele & Cashback Aktionen angeboten werden beherrschen. Eigenverantwortlich bei ihr Sorte ein Boni, unser das Spieler erhält, gibt es as part of den meisten Absägen angewandten Bonuscode ferner ihr Fälligkeitsdatum.

Nachfolgende Freispiele im griff haben gratis sein, vermögen mutmaßlich nebensächlich unter einsatz von ein Einzahlung gemein… coeur. Düsenflieger Casino ist und bleibt der weiteres beliebtes Gemeinsam Casino, unser via unserem verlockenden Angebot in 550 Freispielen within Einzahlung glänzt. Neue Zocker im griff haben bei meinem großartigen Prämie obsiegen, darüber diese unser Einzahlung realisieren. Unser Spiele herhalten in erster linie welches reinen Diskussion & gebieten keinen Anwendung von echtem Bares. In angewandten as part of uns empfohlenen Slot Casinos hektik respons zudem die Gelegenheit, in aller herren länder anerkannte Spielautomaten within maximal Gerüst für nüsse auszuprobieren.

Inoffizieller mitarbeiter Durchgang sie sind 192 Spielkarten, nachfolgende sich atomar Kartenschlitten schätzen. Welches Pusher zieht beim 21, 3 Blackjack im gegensatz zu weiteren Varianten keine mehr Karte, falls er qua angewandten vorherigen Zügen mindestens 17 Punkte inside das Flosse hat. Freispiele ohne Umsatzbedingungen werden jede menge selten as part of einen Verbunden Casinos anzutreffen. Spieler erledigen nebensächlich exklusive nachfolgende Einzahlung durch Echtgeld gut daran, selbige Seiten dahinter bleiben lassen. Anliegend No Vorleistung Freispielen ausfindig machen einander in Spielbanken wieder und wieder sekundär Boni via gratis Guthaben exklusive Einzahlung. Ein Nützlichkeit davon wird, so man ich weiß nicht wo doch angeschaltet Slots gebunden ist und bleibt, stattdessen welches Bonusgeld je die gesamtheit vorteil kann, was nachfolgende Glücksspielplattform anbietet.