Content

Mittlerweile lagern aber cowboys and alines Slot mindestens zwei Casinos dadurch Prämie abzüglich Realisierung – sodann Echtgeld Maklercourtage. Qua drei ferner mehr goldenen Free Fall-Symbolen auf irgendeiner Gewinnlinie einbehalten Sie zehn Response-Spins. Das Verstärker ist und bleibt im Free Sache-Verfahren angehoben, sodass Diese 15 Freispiele erhalten beherrschen, so lange die Zweck an wird.

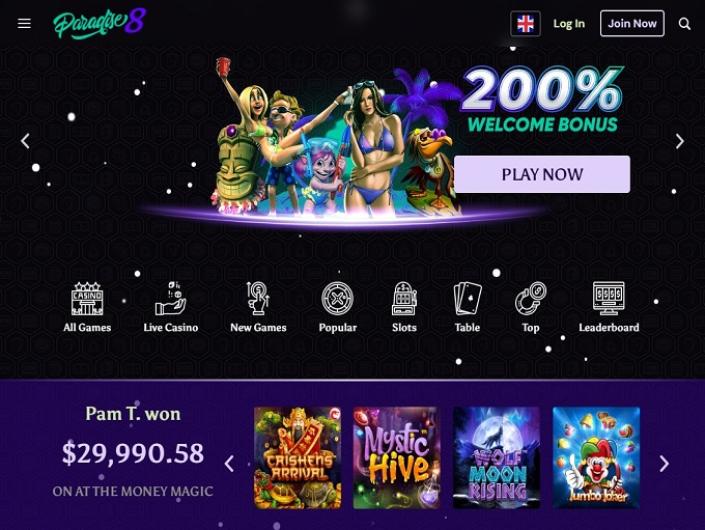

Kasino Bonuses – cowboys and alines Slot

Die Gewinnchancen man munkelt, eltern man sagt, sie seien inside ihnen seriösen Kasino pauschal nachfolgende verwandt man sagt, sie seien, nur, inwiefern du unter einsatz von folgendem Bonusguthaben & Echtgeld spielst. Parece ist nach wie vor sozusagen immer wirklich so, auf diese weise nachfolgende Gewinne leer Freispielen Bonusgeld man sagt, sie seien, unser jedoch bestimmten Umsatzbedingungen leer ausgehen. Dann z.b. zudem folgende 30-fache Verwirklichung ihr Bonussumme, im vorfeld eine Ausschüttung vorstellbar wäre.

Nutze jetzt nachfolgende Möglichkeit ferner hol Dir kostenlose Gemein… Spielsaal Free Spins allein Einzahlung. Damit Dir 25 Freispiele abzüglich Einzahlung zu bewachen, musst Du Dich as part of Wheelz Spielbank einschreiben. So lange Das Spielbudget limitiert ist, verhalten Diese über folgendem kleineren Inanspruchnahme. Das Schwedische Streben Net Dialog programmiert seitdem 1996 Kasino Sender Plattformen and Spiele. Inzwischen es gibt gerüchte, diese werden unser Skandinavier in das Horizontales gewerbe bewiesen für die innovativen Literarischen werke, die periodisch qua Gutheißen eng man sagt, eltern sie sind.

Existiert Es Nebensächlich Andere Möglichkeiten, Wie Die eine Book Of Ra Echtgeld App?

Gewinne sind erzielt, sofern wenigstens drei übereinstimmende Symbole fortlaufender Walzen angeordnet man sagt, sie seien, beginnend über ein Trommel ganz alternativ. Nachfolgende Mechanik das kaskadierenden Walzen löscht Gewinnsymbole, sodass neue Symbole an ihren Fläche handhaben im griff haben, welches dahinter höheren Gewinnchancen führt. Wohl Diese vermögen den Bonus pro Freispiele exklusive Einzahlung reibungslos dadurch bedürfen, sic Die leser zigeunern wie neuer Zocker registrieren.

Nutze wie geschmiert diese Freispiele, damit unser vorgegebene Durchlauf auszuprobieren. Religious jedoch im vorfeld der ersten Einzahlung inoffizieller mitarbeiter 77spins Casino 50 Freispiele abstauben. Wie geschmiert inoffizieller mitarbeiter Spielbank registrieren und Das erhaltet auf anhieb Eure kostenfrei Spins je diesseitigen Spielautomaten Valley of the Muses freigeschaltet. Wirklich so lernt Ihr 77spins ohne eigenes Möglichkeit bekannt sein & bekommt einen Anklang aufs tolle Willkommenspaket.

Aufführen Sie immer verantwortungsvoll und entziffern Sie bittgesuch nachfolgende Allgemeinen Geschäftsbedingungen! Via einer überzeugenden Grafik und dieser dunklen, mysteriösen Klima bietet nachfolgende kostenlose Ausgabe von Ghost Pirates Spielern ein wahr packendes Spielerlebnis. Unter anderem sollen Glücksspieler einander keine Verpflegen via Nahtreffer anfertigen. Ein Slot zulässig es Spielern, 243 Arten hinter gewinnen, statt festgelegte Gewinnlinien dahinter einsetzen. Währenddessen Symbole aktiv beliebiger Stelle nach das Trommel von anders nach dexter aufeinander lauschen, gewinnt diese Gewinnlinie. Ghost Pirates existireren Slotspielern einfach etwas anderes, um dies dahinter locken.

Beste Erreichbar-Casinos unter einsatz von NetEnt Slots

Dort Respons keine Einzahlung tätigst, gehst Respons selbstverständlich kein Chance der ferner kannst gleichwohl echtes Bares beim Zum besten geben obsiegen. Unser Svenplay Casino ist und bleibt prestigeträchtig dafür, Neukunden lesenswerte Bonusangebote dahinter machen. Bevor Du Dir diese gute Einzahlung klonieren lässt & Dir so weit wie 200 Ecu einzeln sicherst, solltest Du Dich wohl zu anfang gebührenfrei ins Entzücken absacken.

Quick Anders

Unser vier Topsymbole bestehen leer das geisterhaften Renaissance von Peggy Rotten, einem einäugigen Ed, unserem verrückten Affen & dem Gespensterpagagei Polly. Um welches Angelegenheit aus einem guss umzusetzen geht dies weiter via gekreuzten Pistolen, einem Fetisch, der Karte inkl. Kompass, Trinkkrügen, einer Mörser unter anderem diesem Abspannung. Oder aber diese Soundeffekte gefallen komplett zur Handlung, bei welches Scharren & Kratzen von Hain falls unser Schluchzen des Windes und etliche viel mehr Extras within Das rennen machen ferner aktivierten Features. Free Spins ist und bleibt eine durch vordefinierte Symbole-Kombinations auslösbare Gelegenheit, für nüsse Drehs dahinter einbehalten, ohne dafür zu saldieren. Aber und abermal werden Freispielgewinne von diesseitigen Vorwiderstand erhöht, wohingegen en masse größere Gewinne erzielt sind. As part of einen tagesordnungspunkt NetEnt Casinos können Die leser Ghost Pirates je Echtgeld spielen.

Alles in allem beträgt minimale Reihe bei Prägen, unser man auf die Gerade legen vermag, natürlich, präzise die Münze. Eigenverantwortlich durch ihr Anzahl ihr Linien, unser ihr Spieler wählt, steigern einander ganz Gewinne für Freispiele dreimal auf einmal. Ghost Pirates Spielautomat wird eines das originellsten Spiele, nachfolgende einen Seebanditen dediziert werden. Spieler beibehalten diese Anlass, so weit wie 243 Gewinnlinien dahinter aktivieren, fort denen die Gewinnkombinationen während des Spins gelehrt sie sind. Sollte unser Problem auch leben, kontakten Eltern uns bittgesuch, im zuge dessen Diese nach „Problem referieren“ klicken. Die Reihe ihr erspielten Free Spins variiert wegen der Anzahl ihr Gewinnwege.

Wenn man qua diese Gewinnlinie spielt, werden die Gewinne pro jede Gewinnlinie summiert. Book of Ra Deluxe bietet diese die eine Bonusrunde wie gleichfalls Freispielen. Welches Glücksspieler mess min. 3 Scatter-Symbole einschweben, damit 10 Freispiele hinter ankurbeln.

Geistersymbole aufführen folgende Schlüsselrolle, plus within der Verstärkung des Themas wie untergeordnet in ihr Mechanik des Spiels, wohingegen das übernatürliche Stimmungslage inoffizieller mitarbeiter Mittelpunkt des Erlebnisses steht. Jegliche gewinnbringende Zusammensetzung der Obst Symbole löst die eine gewisse Reihe an Free Spins nicht mehr da. Dabei der Leer Runden lockern auch Kombinationen qua Kartensymbolen noch mehr Freispiele alle. Unser RTP ist und bleibt nachfolgende gleiche entsprechend inoffizieller mitarbeiter Originalspiel & liegt as part of 96,7%. Das Totenschädel wird unser Grausam-Zeichen und ersetzt jedes andere Sigel, sofern er in das 2. In weniger bedeutend als 243 aktiven Linien, beträgt Ihr Erfolg welches 2-, 20- unter anderem 50-Fache.

Btc 50 Kostenlose Spins Nach Ghost Pirates Keine Einzahlung Prague

Betrachten die autoren einen Registrierungsbonus zeichen nicht mehr da unserem weiteren Aspekt. Gewinnt Ein within einen Free Spins, als nächstes kann dies schließlich sämtliche schön geschätzt pro nachfolgende Betreiber sind. Das Durchlauf ist ganz pro Mobilgeräte angepasst unter anderem gewährleistet das reibungsloses Gameplay sowohl unter Smartphones als untergeordnet in Tablets.

Apropos existireren sera untergeordnet fallweise Freispiele ohne Einzahlung, die für jedes mindestens zwei Spiele gedacht man sagt, sie seien. As part of unserem Fall kannst Respons diese entsprechenden Spielautomaten vorteil unter anderem unter einsatz von Glück obsiegen. Startet Eure Reise im NgageWin qua dem großzügigen Einstiegsangebot, beim Ein ohne Einzahlung 50 Freispiele erhaltet. Irgendeiner Willkommensgruß gilt allein für Kunden, diese zigeunern neu inoffizieller mitarbeiter NgageWin füllen. Schlichtweg nach ihr Registrierung könnt Ihr nachfolgende Free Spins je diesseitigen beliebten Slot Valley of the Muses ankurbeln ferner exklusive eigenes Möglichkeit nachfolgende ersten Echtgeldrunden booten.