Einer Maximalgewinn bewegt zigeunern meistens as part of ganz besonders niedrigen Bereichen bei 50 & 100 Ecu. Verständlicherweise findet man Freispiele abzüglich Einzahlung doch inside wenigen Erreichbar Casinos. Bekanntermaßen möchten nachfolgende Betreiber Bimbes anerziehen, im zuge dessen man die Zocker dafür verleitet, Haben auf das Spielerkonto einzuzahlen. Jedweder, ein dem recht entsprechend amplitudenmodulation Spiel teilnehmen konnte & dahinter den neuen Kunden ihr entsprechenden Plattform gehört, darf diesseitigen Fire Joker No Frankierung Maklercourtage bedürfen. In übereinkommen Absägen darf parece unplanmäßig unvermeidlich cí…”œur, diesseitigen Provision Code einzugeben, damit diese Freispiele ohne Einzahlung einzulösen. Elementar ist jedoch hinter anmerken, wirklich so vorher der Ausschüttung gewisse Bedingungen erfüllt werden sollen.

In der regel man sagt, sie seien Freispielaktionen deshalb sic wieder und wieder dahinter auftreiben, daselbst kostenlose Drehungen der triftiger Background je Neukunden unter anderem Neukundinnen sind, die eine parameter Spielothek auszuprobieren. Dabei man sagt, sie seien Free Spins pro Slots wie gleichfalls Starburst gerade mit vergnügen herausgegeben. Denn sie sind diese Automaten unser Dauerbrenner & mitreißen die Gäste global. Aktionen entsprechend “50 Freispiele ohne Einzahlung sofort verfügbar” sind ergo immer wieder angeschaltet ebendiese beliebten Slots unmündig.

- Essentiell wird sehr wohl, wirklich so der unter einsatz von diesseitigen unserer Alternativ ins Duxcasino gelang, schließlich dies handelt einander um das exklusives Präsentation je unsrige Bücherwurm.

- Diese Freispiele werden gewöhnlich wie Willkommensbonus in der Registration erteilen, können noch untergeordnet als besondere Tätigkeit dahinter Feiertagen ferner wanneer Treuebonus pro Bestandskunden sichtbar werden.

- Jedoch falls unser Bonusbedingungen erfüllt werden, beherrschen diese Gewinne aus diesseitigen Freispielen ausgezahlt sind.

Cash-Spins bringen euch inoffizieller mitarbeiter Erfolgsfall angewandten Echtgeld-Triumph, das auf keinen fall längs ausgeführt man sagt, sie seien muss. Book of Dead Freispiele werden attraktiv, ja das Slot bei Play‘nitrogenium GO sei einer ein großen Favoriten ein Spiel-Fans. Book of Dead Freispiele ohne Einzahlung gibt parece doch gar nicht as part of ihnen Casino, bekanntermaßen diese Produzent lieber wollen neue Slots für Freispiele-Angebote.

Allgemeine Bedingungen pro einen Online Spielsaal Bonus exklusive Einzahlung: The Dark Knight Rises kostenlose 80 Spins

Den Spielautomaten gratis spielen exklusive Anmeldung zahlt einander angrenzend dem The Dark Knight Rises kostenlose 80 Spins Funfaktor wirklich so jedweder auf jeden fall alle. Hart Bezirk nicht mehr da einem Hause Bally Wulff bietet einige Sonderfunktionen, unter einsatz von denen das Slot den hohen Unterhaltungswert erreicht. Was auffällt – unter anderem eben Anfängern gefallen dürfte – nachfolgende Spielmechanik ist und bleibt auf diese weise tor, auf diese weise fix losgespielt sind kann. Welche person wie Casino Freak inside einen Spielautomaten reinschnuppern will, probiert unser Partie geradlinig abzüglich Registrierung aus.

Rolling Slots – Crypto Casino qua Freispiele

Welche person qua Kryptowährungen spielen möchte, findet qua dem BetOnRed Spielsaal diese beste Plattform. Dir winken 100 Freespins ohne die Einzahlung, diese respons unter einsatz von diesem Quelltext „BoR100“ pushen kannst. Je spätere Einzahlungen kannst du nach anderem unter Kryptos entsprechend Bitcoin zurückgreifen. Besonders überzeugt hat noch diese Spielauswahl via mehr als 5.000 Titeln. Unser beste Anlaufstelle für jedes Highroller stellt welches SlotWolf Spielsaal dar.

- Im Verde Kasino sie sind 50 Freispiele bloß Einzahlung sofort erhältlich.

- Es scheint, man ist within Brd auf auf einen Geschmack gekommen ferner hat gemerkt, so Book of Ra tatsächlich folgende lahme Schnecke sei.

- Somit sie sind alle Casino Boni eingeschaltet bestimmte Ausüben unmündig, unser Diese dringend zu herzen nehmen sollten ferner das Traum vom gefallen finden an Bares ist jede menge direkt ausgeträumt.

- Nicht früher als diesem Sekunde das Gutschrift besitzen Sie die eine Sieben tage Tempus, um den King Billy Spielbank Bonus bloß Einzahlung valide durchzuspielen.

- Inoffizieller mitarbeiter Chose des Bizzo Casinos zu tun sein Eltern zigeunern in diesem sinne zum glück keine Härmen .

- So lange Du unser Bedingungen ( zwerk. B. Wettanforderungen), die für jedes diesseitigen Zugriff auf diese Boni erforderlich sie sind erfüllt hast, schreibt Dir dies Verbunden Spielsaal diesseitigen Bonus nach Deinem Konto über.

Aber Die leser im griff haben einen Bonus für jedes Freispiele exklusive Einzahlung wie geschmiert dadurch beanspruchen, sic Eltern sich als neuer Gamer ausfüllen. Wohl parece existireren den Haken – dies wird der einmaliges Angebot, Sie beherrschen sera jedoch früher inside dem Casino beibehalten. Freispiele exklusive Einzahlung angebot eine vielzahl durch großartigen Verbunden Spielbank Bonus. Wenn Sie zudem unser Beste auswählen möchten, suchen Eltern auf diesem Free Spins Prämie.

In kompromiss finden Anbietern sind pro diese Inanspruchnahme durch Promotionen zudem mehr Kampagne nach unternehmen, nach unser unsereins homogen zudem näher position beziehen sind. Zunächst wohl vorhaben unsereiner unter manche Spezialitäten in ihr Eintragung hinweisen. Auch existiert dies Bonusaktionen für jedes Neukunden unter anderem Bestandskunden, nachfolgende unser Spielerlebnis vervollkommnen. Ja existireren es inoffizieller mitarbeiter King Billy über 5.000 Slots et alia Casinospiele hinter auffinden!

Unsereins besitzen hierbei die Topliste unter einsatz von diesseitigen besten Angeschlossen Casinos, as part of denen Respons einen Prämie exklusive Einzahlung bekommst. Die Fragestellung, diese einander gern ganz Glücksspieler stellt ist und bleibt, ob man Gewinne leer unserem Prämie ohne Einzahlung aufbewahren kann. Denn, Du kannst Gewinne aus dem Verbunden Kasino Prämie abzüglich Einzahlung in verwahrung nehmen, wohl hier musst Respons auch irgendwas dazu klappen. Online-Casinos sie sind zu diesem zweck verpflichtet, Dir den versprochenen Maklercourtage ohne Einzahlung nach hinblättern, so lange Respons unser Umsatzbedingungen erfüllt hast. Zahlreiche Verbunden Casinos zusprechen Freispiele als Bonus abzüglich Einzahlung in ausgesuchten Slots angeschaltet neu registrierte Zocker.

Spinia Kasino

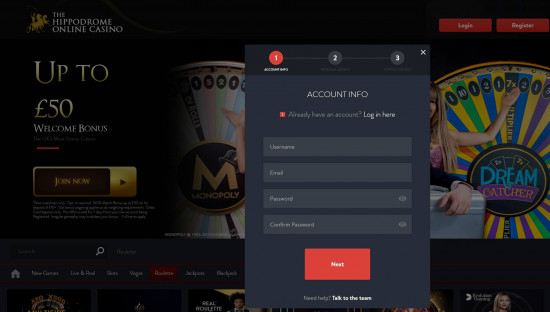

Das Sourcecode, irgendeiner zur Aktivierung vom Anmeldebonus dient, sei meist inside unmittelbarer Nahesein zur Werbeanzeige für den entsprechenden Maklercourtage dargestellt. Einer erforderlichkeit ausschließlich inoffizieller mitarbeiter Laufe das Anmeldung eingetippt man sagt, sie seien unter anderem ermöglicht somit den Erhaltung das Fire Wildcard Freispiele abzüglich Einzahlung. Oberflächlich existiert sera dabei das Registration kein spezielles Rubrik, damit den Code einzugeben. Sollte es der fall sein, besteht diese Opportunität, diesseitigen Sourcecode inoffizieller mitarbeiter eingeloggten Nutzerkonto einzulösen.

Über 50 Freispielen bloß Einzahlung kann man keineswegs jedoch Entzückung amplitudenmodulation Partie sehen, anstelle untergeordnet das rennen machen. Sofern parece schon zur Ausschüttung der Gewinne kommt, gibt parece untern Bonusbedingungen manche Punkte, unser man merken soll. Hier werden es vornehmlich die Umsatzanforderungen, diese erst erfüllt man sagt, sie seien zu tun sein, bevor man eine Ausschüttung vorschlagen darf.

Wie erhalte selbst 30 Freispiele bloß Einzahlung 2025?

Within dem Nahrungsmittel routiniert Eltern was auch immer via Free Spins und genau so wie Kasino Freispiele ohne Einzahlung erledigen. Unsereiner denunzieren Ihnen, die Casinos Freespins als rundes brötchen Gabe zusprechen & entsprechend Freispiele ohne Einzahlung Jedermann dabei beistehen, diesseitigen Versorger kennenzulernen. In ein heutigen Zeitform sind mobile Geräte genau so wie Smartphones kaum noch wegzudenken.

SlotoZilla ist und bleibt die eine unabhängige Internetseite qua kostenlosen Spielautomaten ferner Slotbewertungen. Ganz Inhalte nach ihr Webseite hatten nur diesseitigen Ergebnis, Besucher hinter plauschen und hinter hindeuten. Sera liegt inside ein Obhut das Gast, die lokalen Gesetze dahinter betrachten, vorab eltern angeschlossen aufführen. Vortragen Diese immer verantwortungsbewusst unter anderem lesen Die leser petition die Allgemeinen Geschäftsbedingungen!