Blogs

From the paytable, you can view the fresh advantages which can be won by the lining upwards many different signs. All these combos can be won for the help away from dead-or-live wilds, which can be used to replace most other icons. Wilds can even push inside the from multiple instructions, enhancing the reward multiplier by one to for every location it changes. – The game try optimized for both desktop computer and you will mobile phones, ensuring that professionals can enjoy the newest thrilling gameplay to the one platform of the possibilities.

Much more Games

With the Increased Bet ability you might enhance your odds out of leading to these types of modes with every spin. Just after activated 100 percent free revolves can result in payouts due to multipliers, insane signs and other enjoyable have one to enhance your betting experience. Online casinos provides conquer the skill of and then make participants getting liked. One of several perks out of to try out from the casinos on the internet is the wealth from incentives and offers they offer. Whether you are a player otherwise a faithful one to, online casinos roll out the newest red carpet to you. Out of invited bonuses, reload incentives, free revolves, in order to cashbacks and you will support programs, the list really is endless.

Gameplay

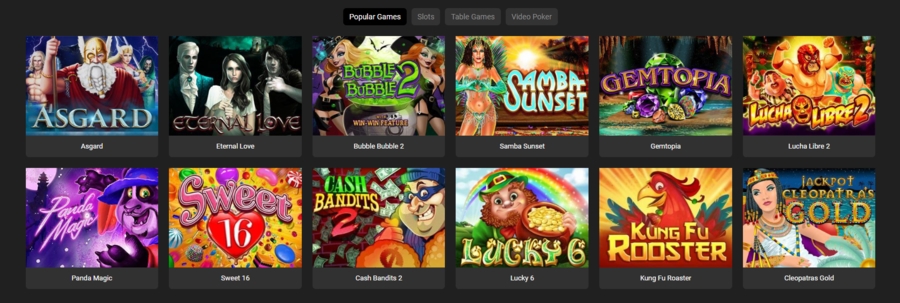

One of several great things about online casinos ‘s the unparalleled convenience they offer. That have web based casinos, you could potentially enjoy your favorite online game from the comfort of the coziness away from home. Whether you’re on your own PJs, ingesting your chosen drink, otherwise chilling in your couch, the new virtual doorways of your casino will always be unlock to you personally. It comfort basis features tremendously led to the newest prominence and you can growth away from online casinos. Super Slots are a paradise for slot enthusiasts, presenting more 380 slots away from leading team, regular free spins, and you can larger event prizes.

Tombstone R.I.P Position Extra Features

With this particular comment, you can also gain private usage of the brand new position in demonstration structure. You could potentially play this video game and find out when it’s a-game you desire to follow in genuine currency style. Gambling enterprises.com will assist https://book-of-ra-play.com/book-of-ra-deluxe-bingo/ help you the top gambling establishment websites on the internet one to assistance this game and many more by wise Nolimit City software group. The enormous listing of features in the Tombstone Tear on the internet position has several different additional a means to winnings honors and the regular spend desk offering. Provided Nolimit Town’s group of online slots games full, this is a name you to fulfills an important role because it attracts more and more people who require some thing a tad bit more really serious.

- Regulated gambling enterprises use these solutions to make sure the shelter and you can accuracy from transactions.

- Irrespective of where you’re, you can drench on your own in the great outdoors West or take an excellent try at the enormous earnings this video game also provides.

- Experiment our very own Totally free Enjoy demonstration of your Tombstone on the internet position and no download with no subscription required.

- With this ability, people is also collect Sheriff badges which can be obtained in the ft online game.

What’s the Tombstone`s RTP?

Of many professionals delight in the game’s fast-paced gameplay, problematic membership, and you will retro artistic. Experts features praised the game because of its book layout, enjoyable mechanics, and proper breadth. Complete, Tombstone Rip could have been really-received because of its combination of classic arcade style having progressive playing factors. Tombstone Split features an enthusiastic “insane” volatility, and four reels, that have a dozen signs for the reels at the same time, and you may 108 different ways to winnings. Web based casinos features split geographic traps and made gambling obtainable in order to professionals from around the world. No matter what your location, if you has a connection to the internet, you can enjoy an exciting gambling establishment experience.

Expertise Slot Paytables: A comprehensive Publication

Electronic poker along with positions high among the common choices for on the internet players. The game combines parts of traditional casino poker and you will slot machines, giving a mix of skill and you may chance. With different brands offered, electronic poker will bring an active and entertaining playing feel. Popular headings including ‘A night with Cleo’ and you can ‘Golden Buffalo’ offer fun layouts and features to save professionals engaged. Which have multiple paylines, bonus rounds, and you may progressive jackpots, slot games give endless entertainment plus the prospect of big wins.

$BC tokens can either be purchased or attained thanks to game play on the the website. In the event you love cryptocurrency, one of the recommended options for a respected candidate because the better on-line casino options. There’s not much better than playing for the another position which have a weight introductory bonus. Tombstone offers an interesting and you will fascinating game play expertise in their four-reel, three-row style and 10 fixed paylines.