The brand new slot’s icons—such as the Priestess, Snake, Mask, Goblet, Necklace, Candle lights, Blade, and you can Scull—are intricately in depth and you may vividly portrayed, taking the theme your in the spectacular trend. Animations getting active and you can smooth, with winning combinations triggering aesthetically satisfying outcomes one enhance your sense away from fulfillment. The new soundtrack increases the action then, that have rhythmical drumbeats and you can strange sounds, remaining you engaged and happy of spin so you can twist.

50 free spins Super Star on registration no deposit – Area Reels No deposit Bonus 80 Totally free Spins!

- The most cash out is 180 as well as the wagering requirements is actually 60 moments the benefit number.

- With cryptocurrency deposit and you can withdrawal alternatives, Black colored Wonders is at the brand new forefront of your world, giving people a seamless and modern betting sense.

- Yet not, there are also of a lot disadvantages to take on prior to triggering an advantage code and making use of it put added bonus give.

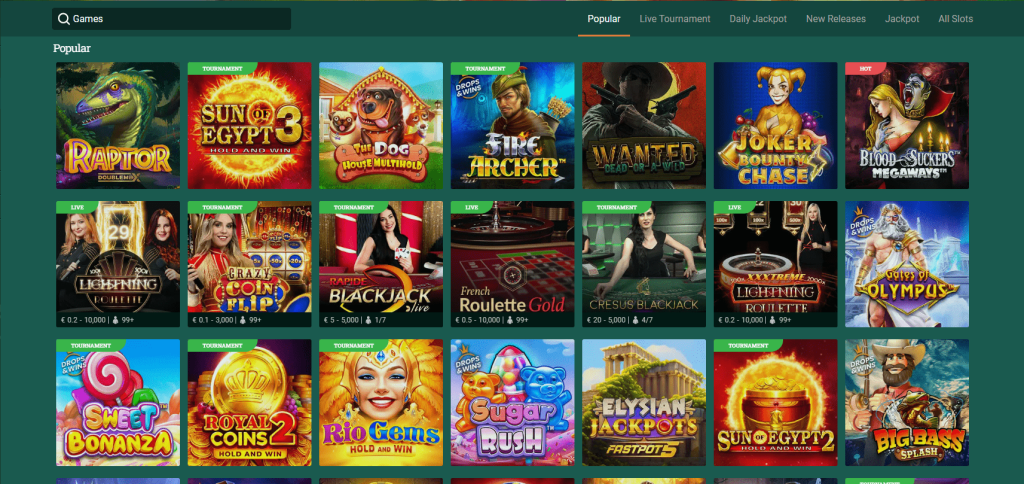

- And because we mate with many different of them, we’lso are in a position to modify our very own lobbies monthly to the extremely latest the new releases.

150 no-deposit free revolves can be obtained because of the becoming an excellent member of the brand new 50 free spins Super Star on registration no deposit gambling enterprise that gives him or her. The new 150 100 percent free spins are provided away without the need for one put as set ahead. If you are scarcely given all at once, they are marketed more than weeks.

That is one other way one casinos be sure people don’t win excess amount with their free revolves. If you victory more than you can withdraw with respect to the small print, you’ll not be able to cash-out your money. Create your online casino gaming safer, fun, and you will effective that have honest and you can unbiased analysis because of the CasinosHunter!

To possess withdrawals, the most and you can lower number to possess confirmed week is 2000 and you may one hundred, respectively. As the all of the distributions are subjected to a protection take a look at, he or she is accomplished inside around three in order to seven working days. During the NewCasinos, our company is invested in getting unbiased and you can truthful analysis. The loyal benefits meticulously carry out inside the-depth search for each site when evaluating to make sure we’re mission and you will total.

Latest bonus codes of Black colored Wonders

- Such, a good 35x wagering specifications is under control, but higher prices or quick timeframes can make the main benefit smaller appealing.

- We’ve analyzed for each extra centered on wagering standards, game possibilities, withdrawal constraints, and complete user sense.

- Overall, Black Miracle Gambling establishment showcases an effective dedication to honesty and you may stability.

- I am the newest elder content publisher during the CasinoCrawlers and you may an author with lots of iGaming content lower than my personal profile.

A number of the popular titles one of many normal professionals is the Mom, Anxiety The newest Zombies, Plagues Of Egypt, Seven and you can Fruit, Purple Lion, and many more. Specific gambling establishment application organization such Netent, Mg and you may Play’N Go features for different grounds limits on the where the game will likely be offered. Also some nations is actually less than limitation due to governmental regulation. So you can make use of this incentive, excite create a deposit if your past training is having a totally free extra.

The new reels of your own slot game are black and so are put facing a keen ominous forest, the the initial thing you will see. The brand new buttons are spooky as well; the low city has bones, gravestones, and you will pots from moving sight. Specific gambling enterprises immediately implement the main benefit, although some need you to manually find it away from a list out of readily available also provides. Shaun Savage ‘s the founder and you will editor-in-captain from Try hard Instructions. He’s got been level and discussing video games for more than 9 years.

Piled Crazy symbol is actually helpful particularly when arrived for the 2nd otherwise 3rd reel. This is when it does result in a few of the large base video game growth, as possible trigger several profitable paylines on one twist. We offer individuals systems such put limitations, self-exemption options, and you may time management to help you stay in control of your own betting sense. If you think you want guidance, see our very own “In charge Gambling” web page for tips and you may help. Gambling enterprise dining table games is a vintage feature, bringing a diverse group of online game one to cater to all player’s tastes.

Snag a hundred – 4000 tournament at the Black colored Revolves

The best casino developers today produce the game in the HTML5 – which small design replaced Flash a couple of years straight back. So the most out of video game discovered at all leading casinos on the internet try cross-equipment compatible and can getting appreciated for the ios and android systems. Many of them as well as brag the same better-made graphics that you could expect to find for the huge Desktop microsoft windows (typically). Lowest withdrawal amounts generally range from 20 in order to fifty to have earnings out of 150 free revolves no deposit incentives.

Native American tribespeople, candle lights, voodoo dishes, bones jewelry, skulls, or other occult items are common movie signs. Yet not, the newest voodoo princess is by far the newest spookiest reel icon; whenever a victory involves her, a near-upwards of their deal with and flashing eco-friendly sight is actually found. The significant (otherwise small!) escape are similarly notable during the a good bingo otherwise gambling establishment web site —Halloween party, Easter, Xmas, National Flowers Time, etc.

Initiate To play Eligible Video game

Specific Gambling establishment internet sites have in addition to reach give money inside crypto currency for example bitcoin and you may Bitcoin local casino web sites try becomming more widespread. It’s be easy to begin with having obtainable commission tips and as well it ought to be very easy to withdraw money in the a money which you as the a player create normally have fun with. It licenses means that the new gambling establishment suits specific community conditions and you will passes through normal audits to make certain fair play and you will athlete protection. Particular casino web sites have now along with come to offer money in the crypto money for example bitcoin. It is an authorized gambling establishment from the Curacao gaming expert and you can boasts SSL encoding.

Simultaneously, certain mages have rare magic types one resist conventional categorization, including Asta’s anti-secret, that may nullify most other enchanting overall performance. “Black Clover” is a Japanese anime series according to the manga of your own same name because of the Yūki Tabata. The story is set within the a magical globe in which everyone can manage different forms out of miracle. When you’re Yuno is actually exceptionally talented in the wonders, Asta are a rare case with no phenomenal element at all. Although not, Asta and it has unyielding dedication and you will physical strength, contrasting sharply with Yuno’s magical prowess.

Be looking to your scatter signs, as these unlock the fresh rewarding Black Miracle 100 percent free Revolves element. Activating this particular aspect continuously can also be rather increase winnings. Most importantly, just remember that , harbors is video game of possibility—thus gamble responsibly, lay a funds, and relish the thrill of one’s game play instead chasing losings otherwise surpassing their limits.