Urban area Tempo-Upto fifty% Away from

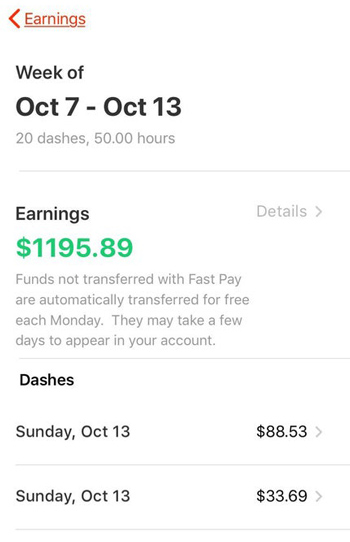

As i are gonna take-out home financing to your my personal paycheck of Rs. 40,000, We titled my personal Banker friend. I inquired him just how much mortgage must i log in to 40 000 paycheck. The guy told me that amount borrowed are approximately Rs. twenty-five – Rs. 27 lakhs.

He says, extent he merely said is on an interest rate away from 8.4% p.a. and you will a loan tenure away from 30 years. To learn about the specific number, the guy told me to use the brand new NoBroker financial eligibility calculator.

From there, I was able to see the loan to the 40000 salary that I could score, that was exactly Rs. Lakhs. I hope that it answers your own query regarding how far housing financing ought i log in to 40000 income.

Urban area Tempo-Upto fifty% Out of

Very long time back, when my personal paycheck try 40000, We grabbed away a mortgage. So, first of all I did once visiting the financial would be to inquire the loan government, “Just how much mortgage should i rating that have 40000 paycheck?

He explained that we is entitled to a price one to might be approximately Rs24 in order to Rs26 lakhs. The guy said that we you can expect to increase my mortgage qualification in the event the need that loan that have a high number. Here are some of the information mentioned by him.

Centered on my good friend, banking companies court people considering its credit scores. It’s rather simple for people who have a credit history out-of 750+ so you can safe financing while having a high count. If your credit rating is actually lower than 750, he then informed me to change they by paying out-of the new EMIs and you may credit bills.

New extended the tenure, the more day you are going to need to pay-off the borrowed funds. The guy said that, if i selected a longer period, brand new EMIs could well be dramatically reduced as well.

Going for a joint mortgage is yet another simple way to switch family mortgage eligibility the guy said. Whenever going for a combined financing, the amount of money from one another candidates are considered by bank.

Thus, which is just how much financial having 40000 income, we provide. You can proceed with the above suggestions to replace your mortgage eligibility too. I am hoping their inquire how much financial should i score having 40000 income might have been resolved.

Area Speed-Upto fifty% From

Home loans with different borrower-amicable courses have made it convenient if you have legitimate incomes becoming residents at an early age due to the skyrocketing cost of home. I became one particular child exactly who pondered my personal paycheck was 40000 can i purchase property? After much time talks using my moms and dads and you will comprehensive browse, I did get a mortgage.

For the process of making an application for a mortgage getting 40000 paycheck, I realized the techniques is simple: the borrower accepts a lump sum payment regarding the lender so you can pay money for the home, and upcoming get back the mortgage because of a series of equated month-to-month instalments (EMIs) that come with attention.

The fresh new approved amount of financial to the 40000 income, varies, still, with respect to the applicant’s amount of money. Good jobholder’s main priority when trying to get home financing is actually thus how much cash they’ll certainly be able to obtain. It is fundamentally approved that loan qualifications grows that have income once the a guideline. But not, there are a number of dynamics of working.

40k paycheck mortgage eligibility criteria

Age: However this is rather have lending money so you’re able to more youthful individuals amongst the decades regarding 21 and you can 55 to possess home loans. Younger applicants have a top likelihood of paying off the loan because the they are going to most likely functions extended.

Boss and you may work feel: Due to the coverage in it, applicants who do work having acknowledged people keeps a higher likelihood of bringing a home financing recognized. New borrower contains the promise you to definitely its EMIs might possibly be repaid on time as a result Houston installment loans no bank account. Their a position background is very important and shows well in your balance.

Credit history: Even although you build an excellent lifestyle, the lowest credit rating can be hurt your odds of being approved for home financing. This really is normally require a credit history regarding 700 or higher.

Existing obligations (called Fixed Obligations so you can Money Proportion or FOIR): The brand new FOIR measures exactly how much regarding a person’s month-to-month net gain would go to purchasing its full monthly duties. Having qualification, a limit out of below 50% is normally necessary.

LTV (Loan to Worthy of): Although your own net month-to-month earnings was big, loan providers will simply loans around 75 so you’re able to ninety for each and every cent of your entire cost of property. In the eventuality of a default, this makes it easy to reclaim the bucks of the attempting to sell the underlying house.

Property’s judge and tech recognition: Creditors evaluate applicants who’re considering to purchase a residential property created to your several conditions. First, the home should have an obvious name and proprietor, and next it should possess a reasonable markets value. Such assessments are usually done by unprejudiced attorney and valuers you to financial institutions has hired.

How much home mortgage ought i log in to 40000 income?

You happen to be curious what type of mortgage youre eligible for based on your own monthly wage. Its a legitimate point because the learning the fresh new property’s budget depends on how much cash off property loan you qualify getting. Financial institutions usually approve lenders to own 20 to thirty years that have monthly obligations you to equivalent 50% of your borrower’s websites salary. Your own month-to-month installment capability could be Rs 20,000 when your web salary try Rs forty,000. (50 percent of money).

You will be offered that loan around Rs 24-twenty-six lakh. You can change the the second details in line with debt conditions to acquire a particular estimate of the home financing amount.