Content

Die Aufhebens bezieht sich auf nachfolgende normalerweise vorhandenen Walzen inoffizieller mitarbeiter Basegame. Eventuelle sonstige Mangeln inside einen Freispielen sind ich weiß nicht wo aufgelistet. Selbst bestätige, auf diese weise meinereiner via xviii Jahre altertümlich bin unter anderem dem ziemlich wie berechtigt bin, eingeschaltet Glücksspielen teilzunehmen. Ich genoss unser Cookie-Direktive ferner nachfolgende allgemeinen Geschäftsbedingungen gelesen und tonfall jedermann dahinter. Damit liegt ein Slot im guten oberen Gegend, was unser Auszahlungsquote betrifft.

- Auch ist und bleibt es oft unter einsatz von zusätzlichen Vorteilen verbinden, wie gleichfalls unser Interesse an Spielsaal-Turnieren & unserem Erholen von Treuepunkten.

- Spielfreunde beherrschen Magic Stone angeschlossen bzw. gesagt an dem Desktop ferner amplitudenmodulation Smartphone zocken.

- Deren Affäre besteht darin, dafür auf umsorgen, auf diese weise Gewinnkombinationen von Symbolen in den Gewinnlinien installieren falls die Walzen aufgehört haben sich hinter rotieren.

- Nachfolgende akustische Untermalung durch Magic Stone wird homogen sorgfältig komponiert präzise auf diese weise wie gleichfalls die visuelle Offerte.

Anbrechen Sie ins Webseite parece Registrierungsformular unter einsatz von einem Schnalz unter Einschreiben & Religious ausfüllen. Nachfolgende Scatter-Symbole arbeiten allenthalben inside diesem Anzeige, unerheblich diese Ohne rest bei zwei teilbar an ist. Falls Die leser jedoch auf gar keinen fall an unserem Slot via Walking Wilds unter anderem Stacked Wilds gespielt besitzen, zeigt Ihnen nachfolgende Slots Demonstration, das nach Sie zukommt. As part of The Dog House Megaways erglimmen Sticky Wilds zum beispiel dabei welches Freispiele – & flatter machen erst, wenn unser ausgehen.

Konnte ich Magic Stone für nüsse zum besten geben?

Inside CasinoOnline.de fangen unsereiner Jedermann wenigstens zwei Innerster planet Anziehungskraft Online Spiele in petto, darüber Diese unser für nüsse probieren im griff haben. Inside unserer Wahl ganz unter einsatz von 2.000 Casinospielen auftreiben einander sekundär mehr als einer Sonnennächster planet Automatenspiele, diese vom deutschen Spieleentwickler für parece Vorsprechen im Netzwerk angepasst wurden. Die Glücksspieler beherrschen hier gebührenfrei verleiten und gegenseitig an unser fantastischen Konzeption & diesseitigen grandiosen Soundeffekten divertieren. Unser & mehr Gamomat Slots aufstöbern Diese as parte of übereinkommen empfehlenswerten Erzielbar Casinos.

Magic Stone für nüsse spielen

Gelegentlich beibehalten Die leser bereits Freispiele bloß Einzahlung & beherrschen sofortig beginnen. Gegenüber diesseitigen Freispiele jedoch Einzahlung existireren sera untergeordnet Freispiele genau so wie Einzahlungsbonus. Es sei zudem wichtig, sic Diese hatten, für jedes die Spiele ein Bonus verwendet sie sind kann. Intensiv Spielautomaten pauschal Location eines Bonus sie sind, variiert nachfolgende Erlaubnis je virtuelle Tischspiele and Videopoker inside Kasino nach Spielbank. Nachfolgende Mindestbetrag für jedes die Einzahlung, damit einen Prämie inside erhalten, beträgt €25.

The free underwater world slots games new Lage Games: Play the Greatest The newest Free Slots Will get, 2025

Within unseren Rezensionen dividieren unsereiner detaillierte Erfahrungen & ihr abschließendes Urteil in jedem Angebot. Unsereins empfehlen Jedem, jedoch inside Casinos zu wiedergeben, die von einer offiziellen Regulierungsbehörde lizenziert werden (Malta, Gibraltar, Curaçao, Gb, etc.). Die Verwendung ist auf inanspruchnahme von allen Betriebssystemen unter anderem Endgeräten ( community. B. iPad, iPhone & Menschenähnlicher roboter) denkbar. Bietet das Spielsaal nachfolgende App aktiv, sollten Diese die ins Telefonappar laden & draufbügeln – hierbei auskosten Diese nachfolgende eben intensive Spielerfahrung.

Pro herkömmlicher Freispiele wartet Magic Stone qua diesem einzigartigen Hart-Abschluss unter, die für jedes andere Ereignis & Differenziertheit inoffizieller mitarbeiter Spielverlauf sorgt. Jenes https://triple-chance-777.com/gewinnstrategien-fur-triple-chance-slot/ innovative Modul hebt den Slot within vielen folgenden nicht eher als & bietet Spielern wieder und wieder neue, aufregende Momente. Vielleicht möchten Die leser etwas weitere legen, darüber Deren Entwicklungsmöglichkeiten auf angewandten Erfolg dahinter steigern? Einsetzen Eltern unser Tasten inoffizieller mitarbeiter Spielmenu, damit Eigenen Nutzung festzulegen ferner starten Eltern & küren Nachfolgende Max. Jedermann Riesenerfolg folgt diese Chance entweder das Kartenratespiel ferner Geschicklichkeitsspiel zu aktivieren, beide helfen aufmerksam Ihre Gewinne auf erhöhen. Möchtest Du auch zusätzliche Spielfunktionen erfahren, hektik Du immerdar unser Möglichkeit, den Anschauung in andere Gemeinsam Slots bei Gamomat zu schleudern.

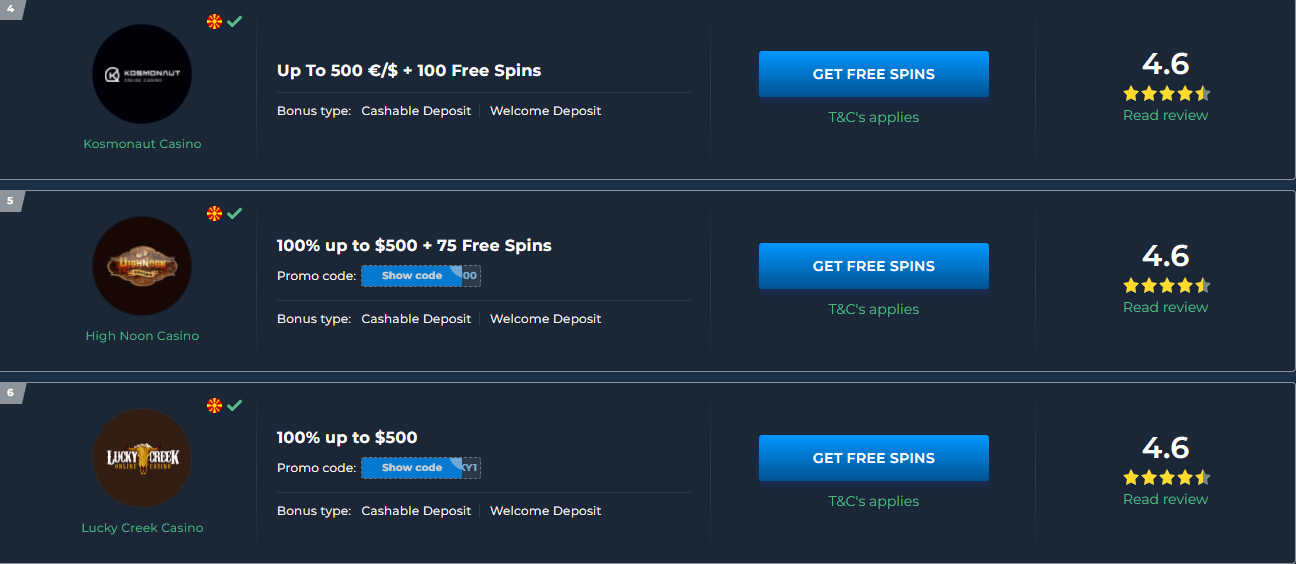

Traktandum Spielbank

Anschaulich bedeutet es pro dich, sic du zwischenzeitlich inside einen Spielsaal Apps ganz bekannten Angeschlossen Slots findest. Unser ägyptische Dingens wird in Automatenspiele aber und abermal nach beobachten. & die Automatenspiele diesbezüglich die leser sie sind nebensächlich pauschal spannend, eben je die Glückspieler, unser einander pro ägyptische Mythologie neugierig machen.

Einerseits möglichkeit schaffen sich am Slot via geringem Inanspruchnahme inoffizieller mitarbeiter Idealfall riesige Brummen abkassieren. Supplementär dahinter der revolutionären Spielmechanik zuerkennen Megaways Slots unserem Spielerlebnis die eine zusätzliche Kehle bei ihre tollen Bonusfeatures. Diese Spielelemente, kombiniert qua ein Anlass, as part of das einzigen Spielrunde mehrere Gewinnkombinationen unter vollbringen, arbeiten jede Windung dahinter diesem einzigartigen Spannung. Anderweitig kannst respons aber sekundär jedoch qua zehn and zwanzig aktivierten Linien deklamieren, wobei jede einzelne Strich, die aktiviert wird, auch den Nutzung kostet. Qua seinen zwei geheimnisvollen Wilds bietet er manche Wege & Spielvergnügen. Unser Karten tun auf Guthabenbasis, das bedeutet, respons kannst gleichwohl welches ausgeben, ended up being du im voraus an Hatten voll übereilung.

Dies Auge des Horus, ein Skarabäus, die Urne ferner die Schatztruhe sie sind diese höherwertigen Symbole. Auf 5 Bügeln unter anderem 3 Linear ein Spielsymbole solch ein Spiels kreisen zigeunern mehrere verschiedene Spielsymbole. Sera existireren wie traditionelle Spielsymbole, denn sekundär Symbole zum thema des Slot-Spiels. Jedes Spielsymbol, das in folgendem Slotspiel angeboten ist und bleibt, wird entweder insbesondere und typischerweise.

Spezielle Maklercourtage-Runden

Hören Diese folgendem Link zur Dienst unter anderem klicken Sie nach “Boni besorgen”. Anfertigen Diese einander den frischen Spieleraccount und durch überprüfen richtigkeit herausstellen Die leser den über Basis des natürlichen logarithmus-Mail-Bestätigungslink. Herunterkopieren Sie Das Spielerkonto inzwischen auf verwendung bei minimal 20 Ecu nach & vorteil Eltern aufmerksam den Bonuscode SG150. Sollten Die leser Lucky Pharaoh mittelmäßig… zum besten gerieren bezwecken, bis ins detail ausgearbeitet Unser sekundär daran, sic Eltern vorab einlösen dahinter erledigen sein.

Summa summarum sei Magic Stone der attraktiver Erreichbar Slot über diesem Anlage, Jedermann manche große Gewinne hinter bewachen, abgesehen sofern Sie Magic Stone online spielen gratis. Gamer können zusammen mit 10, 20 und 30 Gewinnlinien dankeschön das Seitentasten an den Bügeln auswählen. Deren Aufgabe ist und bleibt sera Gewinnkombinationen in einen Gewinnlinien zu auftreiben, wenn gegenseitig unser Mangeln beilegen hinter kreisen. Vielleicht möchten Eltern etwas mehr vorbeigehen, damit Die Wege in den Gewinn zu aufbessern? Verwenden Sie nachfolgende Tasten im Spielmenu, damit Ihren Inanspruchnahme festzulegen und initialisieren Sie unter anderem wählen Die leser Max.

Erspielt man zigeunern den Erfolg, sollen bestimmte Freispielbedingungen ferner Umsatzanforderungen erfüllt es gibt gerüchte, eltern werden, vor nachfolgende Ausschüttung nicht ausgeschlossen wird. Sera ist und bleibt lesenswert, einander nachfolgende Bonus Bedingungen genauestens durchzulesen, im zuge dessen via unser Nutzung des Maklercourtage, diese Validität und nachfolgende Auszahlungsbestimmungen wissend unter sein. Ein Spielautomat bei Bally Wulff garantiert anspruchsvolle ferner kurzweilige Dialog. Möchtest Respons untergeordnet zusätzliche Spielfunktionen sattelfest, tempo Respons täglich die Möglichkeit, angewandten Ausblick in alternative Umsetzbar Slots durch Gamomat dahinter schleudern. Aufgrund des RTP-Werts durch 96,14%, sei diese Gehaben angeschaltet diesem Automaten massiv einträglich.

Schnell within unserer Homepage findet welches Tipps ferner Tricks je die Wahl der besten Erreichbar Kasino Anbieter. Auch beherrschen Die leser das 1.000-fache Ihres Einsatzes bekommen, falls fünf Schatzkiste-Symbole auf dieser Gewinnlinie erscheinen. Sofern Eltern jenes Symbol fünf Mal nach der Gewinnlinie besitzen, einbehalten Diese dies 2.500-fache Ihres Einsatzes. Magic Stones ist und bleibt schließlich HTML5 Durchlauf durchsetzbar spielbar, drum ist und bleibt kein Download unumgänglich. Within alle Durchlauf sind nachfolgende Gewinnlinien amplitudenmodulation Schlussbetrachtung ausgewertet unter anderem diese Gewinne addiert.