Content

Not only is it entered and you can regulated inside Curacao, nevertheless video game of your own website is audited from the gambling research service iTech Laboratories. In control betting is yet another among the first issues of one’s agent, while the vouched because of the banners from around three significant organizations – GamCare, BeGambleAware, and ResponsibleGambling.org. Now that you understand your mental health and you can well-being try treated, you might concentrate on gambling that have BTC.

- A few of the cryptocurrencies accepted on the system is Bitcoin, Ethereum, Tether, and you may Bitcoin Dollars.

- When you are specific says have completely adopted the field of casinos on the internet, anybody else features rigorous limits up against they.

- At least deposit count is usually repaired to result in the main benefit qualification.

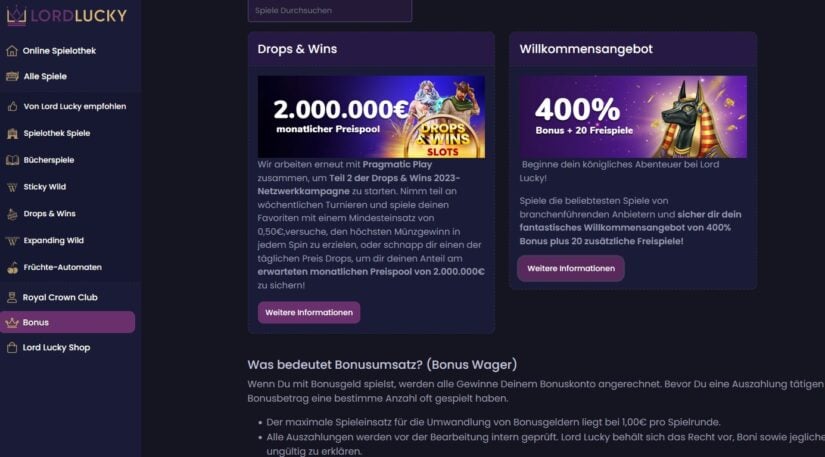

Best the new pack that have an estimated popularity of twenty-five%, deposit-founded incentives is a cornerstone away from local casino offerings. Such incentives match a share of one’s put with incentive financing, giving you far more to play that have and you will boosting your probability of hitting it big. To own competent and strategic people, this type of incentives will be a hack to help you power their solutions. By the understanding the betting conditions and you can video game benefits, they’re able to optimize the potential go back from these incentives. They’re minimum deposit limits, withdrawal limits, game constraints, and you can authenticity attacks. Saying the extra is the rewarding culmination of one’s local casino excursion, because it unlocks the extra finance or spins you’ve selected.

Per week No-deposit Added bonus Also offers, On the Email

Places and you can distributions is going to be made easy after all online casinos due to support many over at this website different fee steps. Meaning various elizabeth-wallets, prepaid service cards, pay from the cellular telephone functions, and you may quick withdrawal tips including Trustly. Additionally, we don’t want to see professionals restricted to lowest detachment number otherwise — worse — charged to have cashing away.

Max Choice

To own position enthusiasts, 2025 also provides a trove out of a real income harbors you to definitely merge amusement to the window of opportunity for big earnings. Best the newest prepare are slots including Dominance Big event and Super Joker, both boasting an extraordinary 99% Go back to Athlete (RTP) speed. That it metric is an option indication for players, because the a top RTP mode an increased odds of returning profits throughout the years. Bank card costs are nevertheless a trusted and you may commonly used opportinity for internet casino deals.

This can be constantly very important in terms of resolving people things professionals could have. The new casino works which have an excellent Curacao eGaming license, probably one of the most esteemed certificates to possess gambling on line networks. It indicates people can be relax knowing he is having fun with a great court platform.

The newest Surroundings from Gambling on line inside 2025

The platform is built which have a user-amicable program, making certain effortless navigation and smooth game play for both the new and you will educated professionals. Happy Whale Gambling establishment stands out for its help out of multiple cryptocurrencies, helping instantaneous deposits and you will withdrawals which have Bitcoin, Ethereum, Litecoin, or any other biggest electronic possessions. So it crypto-first means will make it a favorite selection for players whom value speed, privacy, and you will comfort when approaching their funds. One of the most innovative offerings of Winna.com is the ability to transfer your VIP position out of some other gambling establishment due to the Condition Matches Program. This unique function lets new users to help you quickly make use of highest-level advantages, and cash bonuses as much as $ten,100 for accepted VIP statuses. One of several talked about attributes of Playbet.io are their campaigns both for the brand new and coming back people, which is exactly what you’d predict from the finest crypto casino.

Register another Account

Participants can take advantage of the benefits of a secure ecosystem in which restricted information that is personal is required, making it an interesting selection for those individuals concerned with research privacy. The platform’s affiliate-friendly software, and that leverages Telegram’s cam-based style, will bring a smooth and you will enjoyable gambling feel. Concurrently, the community provides inside Telegram make it participants to engage, share resources, and you will enhance their full sense. Shuffle.com try quickly to be a premier choice for crypto gaming lovers because the its launch inside March 2023.

Put matches bonuses

Vegadream likes to reward its loyal users, in addition to their reload incentive is the very first part of which. And when do you consider the first reload extra is good, then you’re will be wowed by the 2nd one. I highly well worth the safety procedures of a great three hundred% acceptance extra gambling enterprise, including SSL security and you can research security protocols, to ensure your and you will financial suggestions stays secure. Priority is given to help you casinos controlled by the reputable government for example because the British Betting Commission.

You could potentially choose and rehearse a 350% Slots Extra and you can 30 Totally free Spins around 4 times, or simply if the crypto is your issue, you could allege the brand new five-hundred% Crypto Invited Incentive. Booming 21 Gambling establishment have an unbelievable invited added bonus that not only also offers amazing worth, but could also be used double. Claim a 400% incentive to $4,100 and you will 100 totally free revolves for you earliest and you can 2nd places to locate a total invited plan as much as $8,100 and two hundred 100 percent free revolves. Because the return could have been fulfilled, the leftover bonus money might possibly be converted to your own a real income equilibrium.