Content

- 100 percent free Spins to your Register – Regulations and requirements: free bonus no codes no deposit at funky fruits slot

- Get a hundred 100 percent free spins for membership confirmation from the PokerStars

- What’s from the Box – Valentine Slot

- Bónuszok és akciók az on line kaszinókban: Hogyan lehet maximális nyereményt elérni

Always opinion the newest Terms & Requirements to optimize the value of their bonus and you can have fun with trust. Follow the casino’s guidelines to engage your account (age.grams., confirm your free bonus no codes no deposit at funky fruits slot cellular number or current email address). Once we’ve gathered our very own conclusions, we evaluate the newest local casino and its particular incentive to many other records to your record and rates it accordingly. In the event the a winning consolidation is arrived for the reels, the new related winnings on the paytable lighting right up. The newest reels of one’s foot game are ready facing a back ground from fluorescent bulbs in various models. The newest reels are a small of-center to your screen as well as the payline surrounds it.

100 percent free Spins to your Register – Regulations and requirements: free bonus no codes no deposit at funky fruits slot

Place a great £5 bet on Gold Horsey Winner inside one week from subscription. Totally free revolves was paid because of the 6pm a single day after the being qualified wager are paid. To help you allege, check in an alternative membership that have Mega Riches and make at least put from £5. Trigger the benefit through your account’s ‘My Character’ point less than ‘My Incentives’. Use the extra money and you can revolves to the qualified jackpot game and Old Luck Poseidon Megaways.

Finally, it’s one of issues that go on the an excellent semi-challenging chance-restricted product sales take action. No, using a VPN so you can avoid venue limitations are facing local casino principles. In the event the perceived, your bank account can be suspended, and you may profits sacrificed. It’s vital that you read the fine print to find out if your part is approved.

- That is a fantastic treatment for mention the fresh casino’s offerings and you can possibly win real cash without the very first money.

- It’s very easy to skip easy terms and also have your added bonus package and earnings voided because you didn’t comply with the brand new criteria.

- It could otherwise may well not wanted a minimum put, however, wagering conditions always pertain.

Often it’s given since the an alternative pokie incentive otherwise a month-to-month extra render. Yet not, the totally free spins provided for the subscribe have the needs that need to be satisfied, for example time limits. No deposit free spins are typically limited by a certain pokie otherwise number of pokies. You will need to check in the newest terms and conditions in order to come across which video game is excused (and you will wear’t subscribe to the brand new playthrough requirements), or contribute lower than one hundred% . Free spins are among the most widely used gambling enterprise incentives among NZ professionals, however, even with its label, it aren’t always free because they’lso are stated. Both, you’re also necessary to make in initial deposit so you can allege the revolves.

Get a hundred 100 percent free spins for membership confirmation from the PokerStars

![]()

This type of incentive are a great choice for people looking to gamble providing you is, while the currency are often used to mat the cash. This type of video game are in the brand new designs, and therefore are needless to say appealing to crossover admirers. Certain ports features get that might possibly be the brand new and you also can be guide, causing them to stand out from the new co-employee (and you may which makes them an enjoyable experience to play, too). The newest keep service offers plenty of power over the action, because the pulse-beating soundtrack provides the immersed on the video game each of the amount of time.

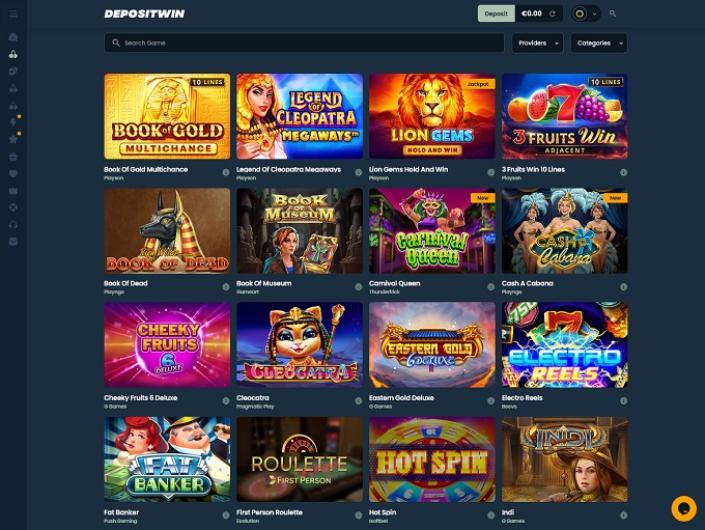

Most web based casinos give these gambling establishment extra advertisements either while the stand alone promotions otherwise included in huge advertising bundles. He or she is designed to focus the fresh professionals and give him or her a great taste of the gambling enterprise’s choices. 100 percent free spin promotions are not private to help you the fresh professionals; of a lot United kingdom gambling enterprises offer totally free spins incentives to their present people. Generally, such bonuses are in the form of reload incentives you to prize participants in making additional dumps. These constant free spins bonuses can come immediately after every week or monthly, according to the gambling enterprise.

What’s from the Box – Valentine Slot

- It’s not ever been better to profits larger your self favourite slot games.

- While you are updating the 100 percent free one hundred revolves incentives, i learned that playthrough is also rise so you can 70x earnings and better.

- And therefore, read the terms and conditions to learn where gambling establishment really stands.

- An example of this is the Super Moolah position, and that bankrupt the nation listing getting the biggest Jackpot repaid in the united states.

These bonuses allow it to be people so you can twist the newest reels away from preferred slot games rather than and then make an initial put, providing a chance to win real money without any financial connection. 50 free spins no deposit bonuses is actually campaigns offered by on the internet casinos that enable professionals in order to spin harbors free of charge without the need for to deposit any cash upfront. Such incentives try a very good way to enjoy the brand new thrill from playing without any financial risk. Fundamentally, participants score the opportunity to speak about some slot video game, spin the newest reels, and also earn a real income rather than to make an initial put. It’s a winnings-victory situation where you can experience the adventure out of gambling on line risk-free, particularly which have free spin bonuses. Using the totally free revolves on the performing slot video game, you might collect earnings.

Of numerous web based casinos render offers and benefits to own faithful players, which means that there may be far more possibilities to twist for 100 percent free and win larger. Wagering criteria determine how many times people need to wager the benefit number prior to they are able to withdraw people winnings. These requirements can vary rather anywhere between web based casinos, it’s imperative to check out the conditions and terms carefully. Fulfilling these standards is essential to efficiently cash out payouts out of no deposit 100 percent free revolves. Karamba Local casino now offers a welcome bundle detailed with up to 500 free spins, split up round the about three deposits, close to paired deposit bonuses.

Bónuszok és akciók az on line kaszinókban: Hogyan lehet maximális nyereményt elérni

Web based casinos get implement regional constraints on their added bonus products. In case your totally free revolves is actually assigned to a limited position, the new gambling enterprise gives a choice you to definitely complies together with your regional regulations. The brand new fifty spins promo are exposure-totally free since you do not need to deposit anything. It is very used in experimenting with the newest online game and casino systems just before investing in them. These types of risk-totally free cycles may come included in the acceptance package offering free spins on the registration instead a necessary fee and you may benefits given following the earliest places. The fresh password is useful to your display, and also for the other information such restriction cashout and you can games offered, you only need click on the Information switch to reveal them.