Content

Constantly carry out thorough lookup on the casinos ahead of entertaining with their promotions and you may examine proposes to identify a knowledgeable no deposit sale. In addition no-deposit added bonus, MyBookie in addition to operates special advertisements such MyFreeBet and you can send-a-friend incentives. These offers provide extra value and therefore are have a tendency to tied to specific online game otherwise occurrences, incentivizing participants to test the new gambling experience. Bistro Gambling enterprise also offers ample invited offers, along with complimentary deposit incentives, to enhance your own first betting feel. These types of promotions have a tendency to come with bonus cash or free spins, providing an additional boundary to explore and you may winnings.

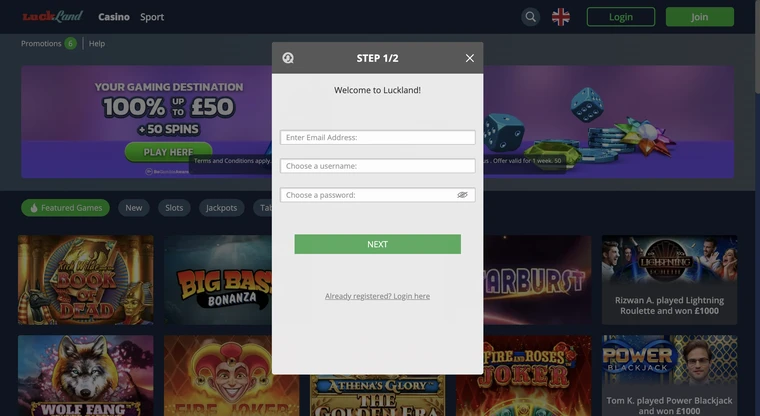

Check out the Promotions Page

Following, navigate through the options in this post to make certain a worthwhile on line betting sense. A no deposit 150 totally free spins gambling enterprise incentive always have extra terms and conditions attached. While you are this type of words often differ according to the online casino your play at the, they’ll mostly are the following. Yet not, there are even of numerous drawbacks to look at ahead of activating a plus password and making use of it deposit incentive give. We’ve got intricate the benefits and you can downsides of using a great 150 100 percent free revolves no deposit incentive less than. You will need to note that usually, an excellent 150 free revolves no deposit strategy will come with high wagering standards.

Evaluating Bonus Conditions and terms

- If you attempt to open up numerous membership, the brand new gambling establishment can get intimate them and withhold one active incentives.

- Bar User local casino $150 totally free processor are energetic and you will included a wide mix of ports and specialization game.

- Gambling enterprises provide many different deposit steps, with best payment supplier assistance.

- It has a somewhat other layout that was enhanced to have pouch-sized house windows, however the features are still the same.

- However, specific rules apply at Coins.Games campaigns.

- There are numerous fascinating 150 100 percent free spins no-deposit perks to possess players.

Mentioned are several of the most popular T&Cs from no-deposit bonus gambling establishment websites. The applicable laws and you may limits uncovered from the all of our reviewers are indexed alongside for each package above. It is best to read the casino’s recommendations about how to allege the no-deposit incentive. Even when he is book or uncommon, if you know how to handle it and you may proceed appropriately, you need to discovered the 100 percent free incentive.

Tricks for Using These $150 No deposit Bonuses

Since these is names invented by selling departments, truth be told there is really no specific really worth for these. Generally we could claim that hyper revolves can be worth $step one.fifty to $5.00 and you may mega spins from $5.00 up to all the way to $20.00 for every round. Especially if the driver try offering countless revolves, they’re handed out inside reduced installments.

I’ve checked out the service if you are focusing on it comment, and the performance were very fulfilling. The fresh representatives presented inside a specialist and you will sincere manner, plus they had been prepared to answer one matter we’d. To own cashouts, the new agent welcomes the same financial procedures in just a partners distinctions. Firstly, you simply can’t explore Neosurf prepaid discount coupons to possess distributions.

Conditions and terms Apply 👉🏽Diving for the our Royal Expert Casino comment to understand more about the its features and you may vikings glory slot review personal incentive possibilities. I’ve viewed additional casinos, but they looked far too complex personally, and so i picked Mega Medusa, and it has already been supposed great so far. The entire reputation of Mega Medusa to your separate review platforms are positive. Much like a number of other gambling websites, Super Medusa Gambling establishment Inclave doesn’t offer a downloadable application to possess pcs and you can cellphones. However, you might however get on on the one system otherwise systems you to definitely supporting HTML5.

Brango Casino Incentive Legislation

A lot of things create this type of promotions within the Southern Africa unique, among which is the undeniable fact that this type of now offers are regularly offered. Rather than having fun with a particular site just ot availability which brighten, gamblers inside the SA are able to find no greatest-right up perks everywhere. That is an enormous in addition to while the profiles have the versatility to help you prefer much more possibilities. For individuals who take a look at a greatest free incentive gambling enterprise, you will see that the fresh processor itself could also give dollars, however must done specific laws to find the matter.

I suggest those people casinos that provide vast, common, and engaging slots. Some other crucial grounds we utilized in all of our rating try betting standards. Casinos that had reasonable and you can reasonable betting standards have been popular to the exact opposite. Regardless of, never assume all offers need you to get into a plus password to help you claim. The brand new casino set it limit to your matter you should buy from the free spins. Any potential earnings a lot more than it cap are often sacrificed because they is low-withdrawable.

A basic 150 100 percent free twist adaptation, the new deposit extra asks participants and make a bona fide currency put before it get access to people totally free revolves. The not surprising that to see why these would be the most frequent 150 totally free revolves sales, for the necessary deposit varying from a single gambling establishment to another. Ideal for you, for the reason that it function you could still claim our very own personal subscribe bonus. The fresh professionals which join at the Spinbetter will be able to claim 150 100 percent free revolves to your Doorways of Olympus.

For this reason, ahead of activating the benefit, you should study the menu of welcome and you can excluded entertainments to avoid affect damaging the legislation. For example now offers are with lots of hidden restrictions one rather affect the odds of after that withdrawals. Inattention to these info can result in the newest annulment of one’s extra or even the clogging of the membership. Along with, high no deposit bonuses act as an excellent reputational positioning unit, especially in a highly competitive ecosystem. A gambling establishment willing to render a $150 no deposit are perceived as a brand name positive about its platform, ready to have demostrated high quality as opposed to a partnership in the athlete.

But you’ll need to register for a free account when you should make very first put and commence using their individual fund. Wagering (or playthrough) standards are very important since they somewhat impact the zero-deposit extra really worth. With 150 100 percent free revolves, the newest wagering conditions reference what number of times you may have to try out as a result of one extra payouts.