Posts

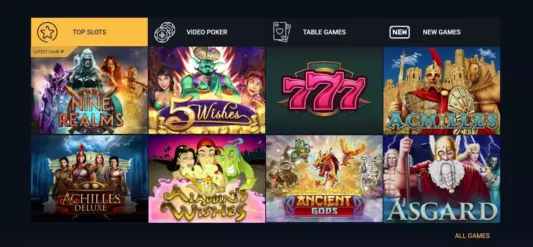

The new gambling enterprise website have a variety of over 500 online slot game, hosted from the better-ranked world designers including Big-time Gaming, NextGen, NetEnt and much more. What’s more, it provides a cool type of progressive jackpots and you can Blackjack tables. Nowadays, internet casino operators make cellular slots appropriate for certain handheld gadgets. Of numerous legal on line slots in the us provides higher commission rates. I encourage looking at 1429 Uncharted Waters (98.5%), fan-favourite Bloodsuckers (98%) otherwise StarMania (97.867%). An informed games also can feature a number of tiered modern jackpots.

This type of need all the work together seamlessly to supply the best experience you are able to. Components through the of these you find, the interest-sweets and beautiful patterns, and others that you do not. The newest mathematics patterns, formulas, plus the application one to https://mobileslotsite.co.uk/jungle-jackpots-slot/ lays behind all the great a real income slot is actually as important as those the thing is. Free spins is actually a position pro’s closest friend, providing the opportunity to victory a real income instead of getting any one of their at stake. Such incentives might be certain to particular game otherwise available across the a variety of ports, delivering a very important opportunity to discuss the fresh headings and you can winnings during the no extra prices.

App Team

- Gamble your chosen harbors on the run, when it’s from your own mobile phone or tablet.

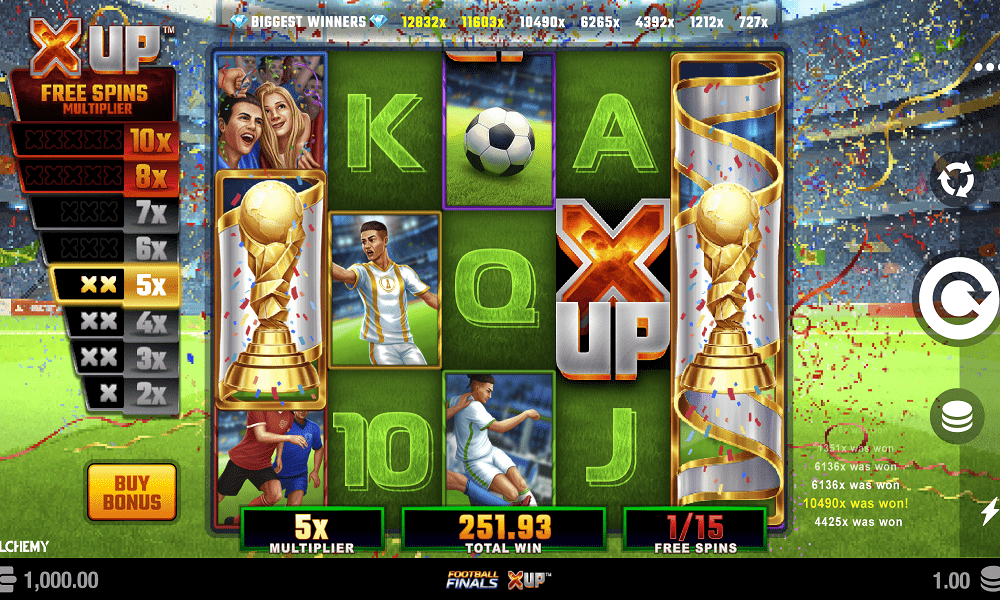

- Particular bonus get slots actually enable you to buy your means in person to the added bonus cycles of one’s games, which is always in which all of the action takes place.

- As well, the usage of timers and time management software may serve as helpful reminders to have professionals to stick to these break behaviors.

- Readily available is actually a no deposit incentive away from 125,one hundred thousand totally free tournament gold coins for new professionals.

Some of the greatest web based casinos one to focus on Us participants is Ignition Gambling establishment, Restaurant Gambling enterprise, and DuckyLuck Gambling enterprise. Web sites are notable for the thorough game libraries, user-amicable interfaces, and glamorous bonuses. If or not your’re also a fan of slot game, live specialist games, or antique desk online game, you’ll discover something for your taste. Although not, a larger kind of cellular casinos are suitable for Android os gizmos. Even when particular applications aren’t available in the newest Google Gamble Shop, Android os pages can always availableness a real income mobile ports because of the downloading APK data, instead of apple’s ios pages.

- Trying out 100 percent free slots helps you dictate your option to own video game volatility rather than risking a real income.

- Slingo game started off simple the good news is are not incorporate crossover provides away from popular slots.

- You’ll provides access immediately so you can numerous games, like the well-known 777 Luxury and you may Wonderful Buffalo.

- It’s a basic gauge of a game title’s fairness, and also the best on the internet slot web sites providing to help you people on the Philippines make certain effortless access to this article.

- However, progressives will usually award larger honors in order to players just who pay the highest stakes.

- Knowing the terms and conditions attached to such incentives will help your maximize its possible and avoid people unexpected limits.

Greatest Online slots to play for real Currency

Because of so many choices to select from, there’s one thing for each preference in the world of online slots games. Roulette is the epitome away from gambling enterprise gaming, and it means little ability. There are a few some other enjoyable wagers you can attempt and now have a number of variations of one’s online game too, and French, Western, Western european, Micro, and you can Dragon Roulette.

It features a great 5×3 grid having 20 varying paylines and you can at least choice out of $0.20 for many who’re also having fun with all the paylines. Providing a mix of fascinating game play plus the opportunity to win huge, Divine Luck is actually a-game you to definitely’s value a chance the jackpot chaser. Actually, specific gambling enterprises even render recommendation bonuses you to definitely incentivize professionals to take new customers for the casino. While you are numerous slot online game business exist, the next stand out because the creators of some of the very celebrated game in the market. Your goal is to obtain normally payment you could, and most harbors are set to invest best the greater your wager. You could lose out on the big harbors jackpots for those who bet on the lower front side.

Ports are generally thought a high-volatility game instead of a high-chance video game. Highest volatility implies that ports tend to have symptoms of repeated smaller gains accompanied by less common however, possibly big gains. This game drops for the sounding average to help you high volatility, giving a great tantalizing limit win away from 2,five hundred minutes their wager.

Dominance Live

They’lso are the new engines behind the brand new ports, desk games, and alive broker experience. Choosing a casino that really works having finest-tier business are an intelligent flow—this means best games top quality, fairness, and accuracy. Crypto Casinos – These are online casinos you to work completely that have cryptocurrencies such Bitcoin, Ethereum, otherwise Litecoin. They’re the same as traditional a real income internet sites however, often appeal to players who well worth confidentiality, prompt purchases, otherwise decentralized platforms.

Whether or not you’lso are having fun with an apple’s ios or Android os equipment, installing the device process is easy and you can intuitive. Proceed with the tips, therefore’ll expect you’ll appreciate your chosen online casino games on the go. Getting and you may setting up local casino apps is straightforward, the same as downloading any app. Make sure that your equipment features sufficient storage and you will follow the tips available with the fresh gambling enterprise’s site otherwise software store. This guide have a tendency to take you step-by-step through the method both for ios and Android os devices, making certain you can begin to experience easily and quickly. Of Insane Gambling enterprise’s comprehensive offerings to help you Las Atlantis Gambling enterprise’s entertaining under water motif, there are numerous choices to boost your mobile betting feel.

An advanced user experience causes enhanced gameplay exhilaration and you can encourages players to expend additional time on the app. An informed casino software work with doing a smooth feel, making sure prompt weight times and simple use of support have. It’s well worth detailing you to definitely betting standards don’t impact certain mobile online game on the certain online casinos. For individuals who receive multiple incentives on your membership immediately, wagering will work with one by one.

How to Enjoy and you can Winnings Online slots for real Money – Info & Strategies

To your rush of your own electronic as well as the introduction of private technology new potential to own entertainment is actually opening, and the gambling enterprise market is not any different. The brand new popular rise of the casino to the cellular have switched the new communications amongst the user and the online casino games. Cellular slots and other exciting mobile casino games today offer a keen fascinating assortment of mobile gambling enterprise experience, undertaking a whole lot of engagement never before viewed. Regarding access to, participants is now able to be involved on the finest mobile gambling enterprise on the web knowledge. A knowledgeable online slots games to experience utilizes your own personal choices. You happen to be in the mood so you can exposure it huge which have a modern jackpot slot, or if you may want to get involved in it safer which have a penny slot.

You’ll get access to alive and you will virtual online game, as well as over eight hundred on the internet slot games for the absolute minimum put from $twenty-five. Capture a virtual travel with Eu Roulette, or twist your own rims during the Legend out of Horus slot machine. New registered users can get a 500% added bonus which fits the original three deposits having a chance to winnings around $7,five hundred. Ducky Luck Casino offers a person-friendly webpages and you will an alternative VIP system that provides incentives to have using compensation points. Cellular optimisation is extremely important to possess British casinos on the internet, since it allows people to enjoy their most favorite video game at any place with internet access.

The easy to use design and you can successful procedure make it a primary possibilities for cellular gamers. With regards to protection, PGasia Gambling enterprise is actually signed up possesses 128-piece SSL encryption to be sure investigation security. The game are often times examined to own equity and you may randomness from the RNG technology. The platform as well as encourages in charge gaming, that have a distinctly written words & conditions, and association having gaming help groups. Therefore, PGasia Local casino try a legal, secure, and you may reliable on line gambling system. Staying advised in regards to the courtroom condition of casinos on the internet on the condition is vital.