To order a home is amongst the most significant decisions when you look at the anyone’s lives and a capital too. Moving into a different sort of domestic and you can remaining that which you finest are an effective fantasy for the majority of. But to invest in Lisman loans a dream home shouldn’t be a monetary headache for you. Well, within this situation, home financing on the internet is good version of financial assistance if you’re brief into cash or perhaps not throughout the aura of completing your offers.

Whether you are awaiting to get a different family, the brand new credit markets also offers of a lot mortgage potential that will be profitable and you can beneficial. Throughout the years, tech changed a few things to your credit world. Towards the simple and fast loan approval techniques, it becomes much easier purchasing a home of your choosing. Everything you need to know is your real requirements and an effective little bit of information about the borrowed funds techniques to construct the dream home. Whenever you are fresh to that it financing industry, here is what you have to know before you go to come towards home loan process that makes your sense hassle-100 % free!

Browse the Assets Area

Men and women would like to get a house in the most useful location, towards best landscaping and you may business to be able to call a place your individual. Very before you proceed towards loan techniques otherwise accomplish a property, definitely read the set twice as its good one-date investment. Our house it comes to is within the safer area that have every earliest place particularly hospital, markets, university, school, place of work things are nearby. This is going to make your daily life much easier and issues-100 % free.

Time to Look at your Credit score

Before applying to own a homes mortgage, it’s very required to check your credit rating as it takes on a crucial role from inside the granting the loan software. Which have a good credit score such as 750 or even more can assist you have made a diminished desire financing. But when you don’t have a rating, you could potentially still improve it and apply for a financial loan. For example paying down your debts, EMIs, and credit card debt punctually will help you to during the improving your score.

Compare Before applying

When you start applying for home financing online, do not just be happy with the original financial your connect with. Create proper browse to see numerous loan providers, compare the financing have and you will rates of interest, and you can based on your benefits, try for you to.

Consider the Rates

Once you make an application for home financing on the web, the speed is actually a primary situation to search for. Additional loan providers render repaired and you may floating costs. Into the drifting cost, interest levels try automatically adjusted depending on sector standards and fixed pricing dont transform. The interest pricing for lenders can vary regarding lender to lender otherwise of lender to help you lender, so be careful regarding the rate and repayment months, following pertain.

Ensure Regarding your Financial Cravings

Your ount regarding mortgage than you prefer but you should not carry it. Before applying, be sure to is also pay off the quantity promptly without the challenge because you need to make a downpayment as well. So it’s vital that you know the way much you need, period several months, and you will EMIs before moving on. Also if you’re applying for a home loan on line, look at the following the charge as well operating fees, possessions fees, legal or other charge.

Number to own Making an application for a property Mortgage

- Your age would be anywhere between 21 so you’re able to 65 years

- Is going to be salaried otherwise notice-employed

- The brand new applicant are going to be a keen Indian citizen

- Try to incorporate an effective co-candidate that can help make your loan acceptance convenient whenever you are to make certain all the way down interest levels

Getting a home loan is actually Effortless with Buddy Financing

Browsing move into yet another domestic? But no solid economic hand to be of assistance. Need not stress because Pal Loan, one of the recommended financing aggregators is here in order to get financing smoothly and effectively. Of 1000 so you can fifteen Lakhs, you could potentially get a loan as per your needs having a straight down rate of interest doing on % p.an effective. you get an adaptable payment months that ranges of 3 weeks to help you 5 years. Thus anticipate to get your fantasy home now.

Step-by-step Assistance to own Using Mortgage

- Before deciding toward lender, you need to contrast and look at your loan requirement, qualifications criteria, credit score, and other situations.

- Go through the interest, installment procedure, and you may mortgage period that may build your loan control sense better.

- After you go after an educated lender, it is time to fill up the loan software and you will fill in it. Now the procedure is most easy and effortless as possible exercise online and requires restricted papers.

- Just after submission the desired financial files and other anything, the borrowed funds vendor tend to be certain that everything, complete the loan number, and you can telephone call one provide more information.

- And finally step was disbursal. Brand new approved matter could be credited to your account and you also can stick to the plans of purchasing a house.

Choosing to possess a mortgage is easy today. Fulfilling all requirements and achieving every records makes your loan acceptance processes smoother. Why hold off? Apply for financing on line now and just have your dream household today!

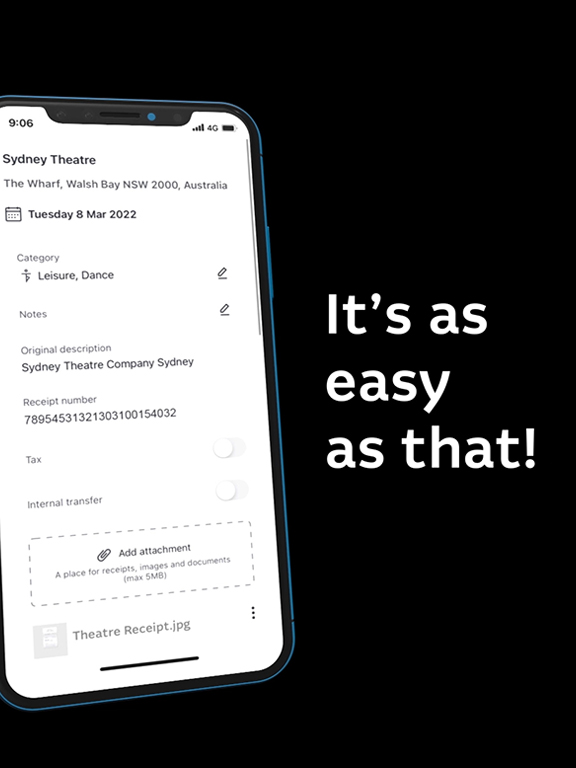

Download Personal bank loan Application

Wanting a fast financing? Pal Financing can help you rating an instant loan on ideal RBI-recognized loan providers. Download the new Pal Loan Application on the Enjoy Shop or Software Store and implement for a financial loan today!